"Early To Bed, Early To Rise, Know Your Numbers And Advertise"

![]()

![]()

![]()

![]() Unfortunately, with everything contractors like you need to do every day including weekend and holidays it’s too easy to let crisp, timely Financial Reports go unread and in some cases, you may not fully understand what they are telling you when you do read them.

Unfortunately, with everything contractors like you need to do every day including weekend and holidays it’s too easy to let crisp, timely Financial Reports go unread and in some cases, you may not fully understand what they are telling you when you do read them.

#1 Not Tracking Direct Construction Costs For Each Job Or Project

![]()

![]()

![]() If you want to know where you are making and losing money you need to implement a system of Job Costing.

If you want to know where you are making and losing money you need to implement a system of Job Costing.

![]()

![]()

![]() These Reports Can only be found in the Premier Contractors and Accountants editions of QuickBooks. Some of them are also available in the Professional Services edition.

These Reports Can only be found in the Premier Contractors and Accountants editions of QuickBooks. Some of them are also available in the Professional Services edition.

![]()

![]()

![]() We offer Job Costing Report Service click on the button below to learn more

We offer Job Costing Report Service click on the button below to learn more

#2 Not Allocating Overhead To Jobs

![]()

![]()

![]() In order for your Job Costing and Job Profitability Reports to be useful you need a way to allocate overhead among jobs. Overhead generally refers to costs that benefit all jobs.

In order for your Job Costing and Job Profitability Reports to be useful you need a way to allocate overhead among jobs. Overhead generally refers to costs that benefit all jobs.

For Example:

- Office And Shop Rent

- Office Supplies

- Admin Staff Salary

- Officer Owner Salary

- Marketing And Advertising

- Consulting, Legal, And Accounting

- Other Overhead Costs

![]()

![]()

![]() Successful Construction Companies have a system to allocate a percentage of overhead among jobs based on field labor or field labor hours. The problem here is overhead costs may be over or under allocated which creates a distorted picture of job profitability.

Successful Construction Companies have a system to allocate a percentage of overhead among jobs based on field labor or field labor hours. The problem here is overhead costs may be over or under allocated which creates a distorted picture of job profitability.

![]()

![]()

![]() For example, if your projects are material and other costs intensive, rather than labor intensive, you may consider allocating overhead based on one of those costs or perhaps some blend of direct job costs. The key is to develop a method for allocating overhead costs to the jobs that drive them.

For example, if your projects are material and other costs intensive, rather than labor intensive, you may consider allocating overhead based on one of those costs or perhaps some blend of direct job costs. The key is to develop a method for allocating overhead costs to the jobs that drive them.

#3 Change Orders

![]()

![]()

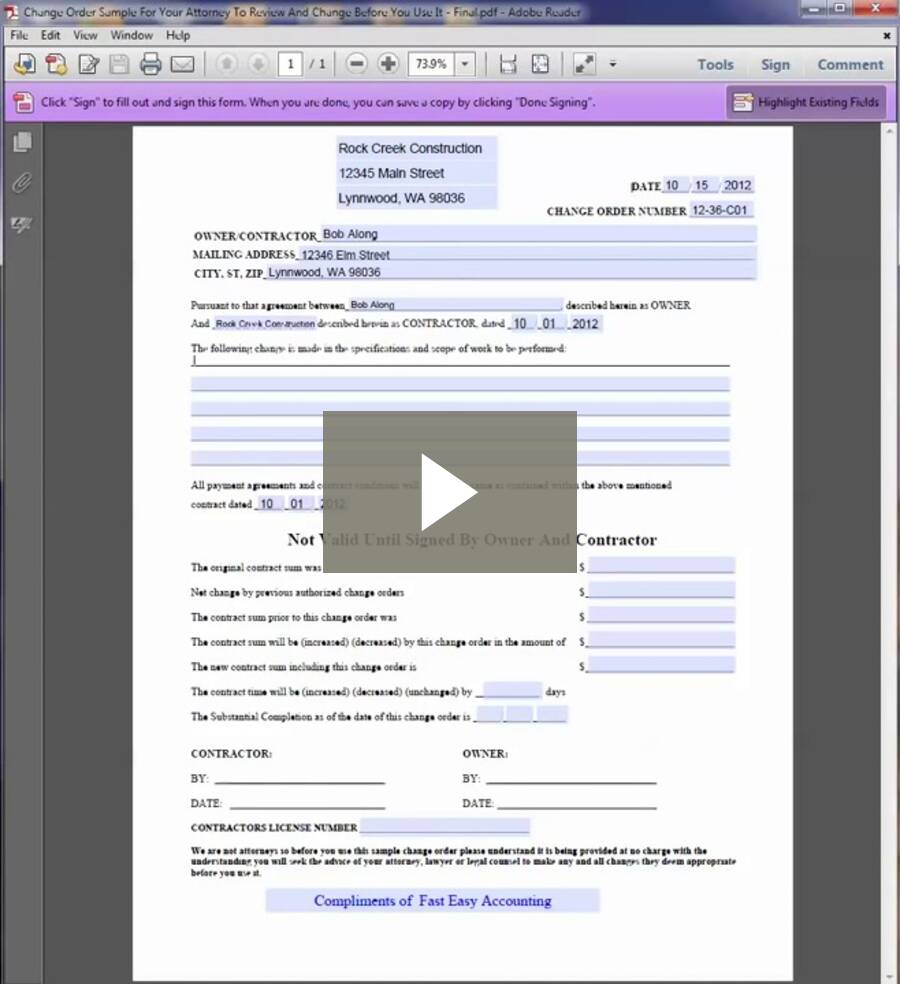

![]() Change orders can be a great source of additional cash flow and profits as well as pitfalls and money drain and lost profit opportunities for contractors. Let me share a true story.

Change orders can be a great source of additional cash flow and profits as well as pitfalls and money drain and lost profit opportunities for contractors. Let me share a true story.

Home Improvement Contractor, Virginia USA

![]()

![]()

![]()

![]() He called Sharie, our Client Care Coordinator and his first words after hello were: "I found your how-to video about change orders and really like how you have it set up and appreciate the pointers you had to offer."

He called Sharie, our Client Care Coordinator and his first words after hello were: "I found your how-to video about change orders and really like how you have it set up and appreciate the pointers you had to offer."

![]()

![]()

![]() He was sick and tired of customers constantly changing stuff on him and creating delays or extra work. He needed to be compensated for his time and his crew time but wanted to make sure he was doing it the right way.

He was sick and tired of customers constantly changing stuff on him and creating delays or extra work. He needed to be compensated for his time and his crew time but wanted to make sure he was doing it the right way.

Construction Change Order Video

![]()

![]()

![]()

![]() This video shows you step by step the Fast Easy Accounting way to work with your Free Construction Change Order Form. We certainly hope this will help you increase construction sales and bottom line profit by getting paid for all the extra work you are doing.

This video shows you step by step the Fast Easy Accounting way to work with your Free Construction Change Order Form. We certainly hope this will help you increase construction sales and bottom line profit by getting paid for all the extra work you are doing.

![]()

![]()

![]()

![]() Contractors are our heroes so we want to help you achieve your definition of success! During a short phone interview with me, he shared his story of how this change order template helped him sell new work and get a check today! He must have read our article on Contractors Are Not Bankers!

Contractors are our heroes so we want to help you achieve your definition of success! During a short phone interview with me, he shared his story of how this change order template helped him sell new work and get a check today! He must have read our article on Contractors Are Not Bankers!

Recap:

![]()

![]()

![]()

![]() He found the same thing most contractors have learned about how “Change Orders” become favors! Why, because by the end of the job he had forgotten all of the things he did that were not part of the original Scope of Work. Since he wasn’t clear with the customer about paying for those "Minor Changes" they ended up costing him time, money and profit.

He found the same thing most contractors have learned about how “Change Orders” become favors! Why, because by the end of the job he had forgotten all of the things he did that were not part of the original Scope of Work. Since he wasn’t clear with the customer about paying for those "Minor Changes" they ended up costing him time, money and profit.

![]()

![]()

![]()

![]() He said after watching the video he downloaded the FREE Change Order Template Click Here for a Free copy of it.

He said after watching the video he downloaded the FREE Change Order Template Click Here for a Free copy of it.

![]()

![]()

![]()

![]() Since it is built on Excel he said it was easy to insert his company letterhead, customize it with a few additional lines for description and save it to his desktop.

Since it is built on Excel he said it was easy to insert his company letterhead, customize it with a few additional lines for description and save it to his desktop.

He Printed Some Copies And Put Then In The Job Folder

![]()

![]()

![]()

![]() Today his customer asked about some changes that she was thinking about doing in the future. They discussed it and between them, and they decided that it the most economical to do the additional changes.

Today his customer asked about some changes that she was thinking about doing in the future. They discussed it and between them, and they decided that it the most economical to do the additional changes.

![]()

![]()

![]()

![]() Remembering the “Brand New Change Order Form” in his Job Folder he filled one out, explained the additional time and material involved to make the change…the customer agreed it was quite a lot to make the changes she wanted; however, she wanted it done so she happily went and got her checkbook and wrote a check for the change order.

Remembering the “Brand New Change Order Form” in his Job Folder he filled one out, explained the additional time and material involved to make the change…the customer agreed it was quite a lot to make the changes she wanted; however, she wanted it done so she happily went and got her checkbook and wrote a check for the change order.

![]()

![]()

![]()

![]() This customer is truly one of his Top 20% that he needs to stay in contact with and become her only contractor. Hopefully, she will refer him to service for everything she needs to maintain her home.

This customer is truly one of his Top 20% that he needs to stay in contact with and become her only contractor. Hopefully, she will refer him to service for everything she needs to maintain her home.

Have Your Customers Started A Conversation With:

-

While you are here anyway...

-

That Should Be Included...

-

Since It's Open Anyway...

-

You Get It Wholesale...

-

It's A Small Change...

-

While We're At It...

-

It's Easy For You...

-

I Have An Idea...

-

I Need A Favor...

![]()

![]()

![]()

![]() If you answered yes here is the good news. People love to buy things and all you have to do is be easy to do business with. One of the best ways to keep your attitude positive is knowing and applying the 80-20 Rule For Contractors. This one tip alone can help keep more cash flowing into your company.

If you answered yes here is the good news. People love to buy things and all you have to do is be easy to do business with. One of the best ways to keep your attitude positive is knowing and applying the 80-20 Rule For Contractors. This one tip alone can help keep more cash flowing into your company.

The 80 20 Rule For Contractor Success At The Money Game  #4 Job Costs Not Included In Financial Statements

#4 Job Costs Not Included In Financial Statements

![]()

![]()

![]() Most Construction Companies track costs using Accrual Basis of accounting and pay tax on Cash Basis. This means recording revenues when earned and expenses when incurred. Some Job Costing errors occur when Direct or Indirect Job Costs are not included in the financial statement.

Most Construction Companies track costs using Accrual Basis of accounting and pay tax on Cash Basis. This means recording revenues when earned and expenses when incurred. Some Job Costing errors occur when Direct or Indirect Job Costs are not included in the financial statement.

![]()

![]()

![]() The reason is simple, bills from suppliers and vendors aren’t received until after the period is closed and financials have been issued. One way around this is implementing a voucher system or some other mechanism to ensure costs are recorded as liabilities or accrued costs in the period in which they’re incurred. This makes sense if your construction company annual sales are over $5,000,000.

The reason is simple, bills from suppliers and vendors aren’t received until after the period is closed and financials have been issued. One way around this is implementing a voucher system or some other mechanism to ensure costs are recorded as liabilities or accrued costs in the period in which they’re incurred. This makes sense if your construction company annual sales are over $5,000,000.

#5 Job Estimates Are Not Accurate

![]()

![]()

![]() Contractors with annual sales under $10,000,000 typically use "Completed Contract" method for financial reports. Contractors with annual sales over $10,000,000 may have to use "Percentage of Completion" method for financial reports.

Contractors with annual sales under $10,000,000 typically use "Completed Contract" method for financial reports. Contractors with annual sales over $10,000,000 may have to use "Percentage of Completion" method for financial reports.

Errors can be traced back to:

![]()

![]()

![]() ⦁ Poor estimating or forecasting

⦁ Poor estimating or forecasting

⦁ Inaccurate recording of actual costs

⦁ Mishandling of change order accounting

![]()

![]()

![]() One of the best ways to avoid the effects of estimating errors is to reconcile actual to estimated costs on a monthly basis.

One of the best ways to avoid the effects of estimating errors is to reconcile actual to estimated costs on a monthly basis.

![]()

![]()

![]() Editor Note: After many decades of working with contractors and Construction Accounting I can say with 100% conviction contractors with annual sales under $1,000,000 are in a sweet spot and can easily generate an annual take-home income of 10% to 20% of annual sales without all of the massive headaches of running a big contracting firm.

Editor Note: After many decades of working with contractors and Construction Accounting I can say with 100% conviction contractors with annual sales under $1,000,000 are in a sweet spot and can easily generate an annual take-home income of 10% to 20% of annual sales without all of the massive headaches of running a big contracting firm.

#6 Recognizing Loss In The Wrong Period

![]()

![]()

![]() Construction companies that use the Percentage Of Completion method sometimes misjudge whether or not a job is likely to be completed at a loss. Generally Accepted Accounting Principles require them to fully recognize the loss at the time it’s determined.

Construction companies that use the Percentage Of Completion method sometimes misjudge whether or not a job is likely to be completed at a loss. Generally Accepted Accounting Principles require them to fully recognize the loss at the time it’s determined.

![]()

![]()

![]() Regular review of each project’s job cost schedule. In the event, estimated costs exceed the contract amount, be prepared to accrue a loss.

Regular review of each project’s job cost schedule. In the event, estimated costs exceed the contract amount, be prepared to accrue a loss.

#7 Joint Ventures

![]()

![]()

![]() "A Partnership Is The Only Ship Designed To Sink" - Randalism

"A Partnership Is The Only Ship Designed To Sink" - Randalism

![]()

![]()

![]() Joint ventures are a bit like change orders. They can be an incredible opportunity to make or lose a lot of money very quickly. Almost as quick as betting money on a roulette wheel in a casino.

Joint ventures are a bit like change orders. They can be an incredible opportunity to make or lose a lot of money very quickly. Almost as quick as betting money on a roulette wheel in a casino.

![]()

![]()

![]() Joint Ventures have their own accounting rules. The devil is in the details because how costs and profits are shared among the participants depends on how the joint venture is structured and the terms of the agreement.

Joint Ventures have their own accounting rules. The devil is in the details because how costs and profits are shared among the participants depends on how the joint venture is structured and the terms of the agreement.

![]()

![]()

![]() Avoid errors, leave nothing to chance. Be sure you and the other party agree on how the income and expenses will be dealt with in your accounting systems before you start work. Implement processes and procedures to ensure the venture’s activities are properly documented.

Avoid errors, leave nothing to chance. Be sure you and the other party agree on how the income and expenses will be dealt with in your accounting systems before you start work. Implement processes and procedures to ensure the venture’s activities are properly documented.

![]()

![]()

![]() Editor Note: Contractors with annual sales less than $10,000,000 often get together to work on a specific project. For example, a concrete contractor may have a large project that requires more finishers than they have on staff. They find a friendly competitor to supply labor and equipment for a percentage of the job, hourly fee or a flat number. This could technically be a "Joint Venture"; however, the time and scope are normally short and sweet.

Editor Note: Contractors with annual sales less than $10,000,000 often get together to work on a specific project. For example, a concrete contractor may have a large project that requires more finishers than they have on staff. They find a friendly competitor to supply labor and equipment for a percentage of the job, hourly fee or a flat number. This could technically be a "Joint Venture"; however, the time and scope are normally short and sweet.

"Early To Bed, Early To Rise, Know Your Numbers And Advertise" - Randalism

![]()

![]()

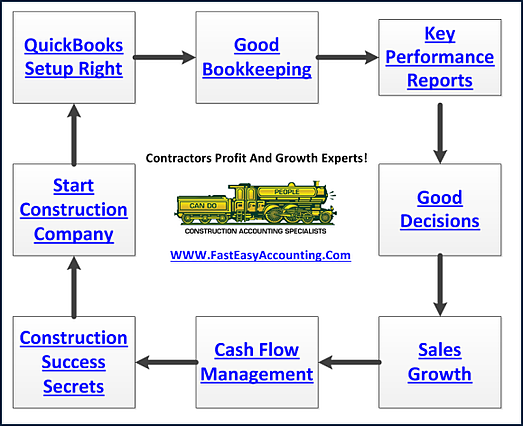

![]() Construction is notoriously known as a thin profit margin high-risk business. Proper planning and Strategic Bookkeeping can reduce your risk and substantially increase your chances of success.

Construction is notoriously known as a thin profit margin high-risk business. Proper planning and Strategic Bookkeeping can reduce your risk and substantially increase your chances of success.

![]()

![]()

![]() Accurate financial reporting is important the profit and growth of your Contracting Company and enjoying favorable relationships with sureties, lenders and other stakeholders.

Accurate financial reporting is important the profit and growth of your Contracting Company and enjoying favorable relationships with sureties, lenders and other stakeholders.

About The Author:

![]()

![]()

![]()

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

![]()

![]()

![]() Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

![]()

![]()

![]() Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

![]()

![]()

![]() PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

![]()

![]()

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

![]()

![]()

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]()

![]()

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]()

![]()

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]()

![]()

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]()

![]()

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar