Messy Bookkeeping Happens Just A Little At A Time

When Contractors are doing their own bookkeeping, it becomes a problem that grows and grows

There is not any limits to the number of transactions that can be entered into QuickBooks improperly. Messy files build transaction by transaction or more simply put invoice by invoice, receipt by receipt all can be entered into QuickBooks improperly. There is no popup that says “This Is WRONG” – Do It Over.

Unlike loading the dishwasher or washing socks which have an end. You run out of dishes or can’t find clean socks. Filling up the dishwasher will magically produce clean dishes. After loading, adding soap, and pushing start the rest happens automatically. Quality of clean dishes depends on soap, how you load the dishwasher and finally, pre-rinsing is optional depending on the dishwasher

Same with the washing machine, fill up the machine, add soap, and turn on the machine. Better results happen with a little bit of sorting by clothing type or color. The washing machine will wash either way. Yhe clothes will come out clean. The unanswered question until the load is done is: Will the T-shirt still be white? Are the colored clothes the same exact color as when they went into the washing machine?

Many Contractors Practice The Keep It Simple Method For Bookkeeping

Put all of the receipts in the drawer. Out of sight and out of mind. The drawer is next to the computer with the QuickBooks for Contractors or other Bookkeeping Software on it.

Using the power of Wishful Thinking; the hope is that the transactions will “Magically Appear” into the Bookkeeping software without any additional assistance from them.

Unfortunately, with all of the technology available; it still requires the help of a “Real Person” with skills to know where to put the transaction into the system.

Does Income Exceed Outgo? – Short Answer Yes, there is still money in the bank, and ALL of the bills are paid. Do Problems Come From Not Knowing What To Do?

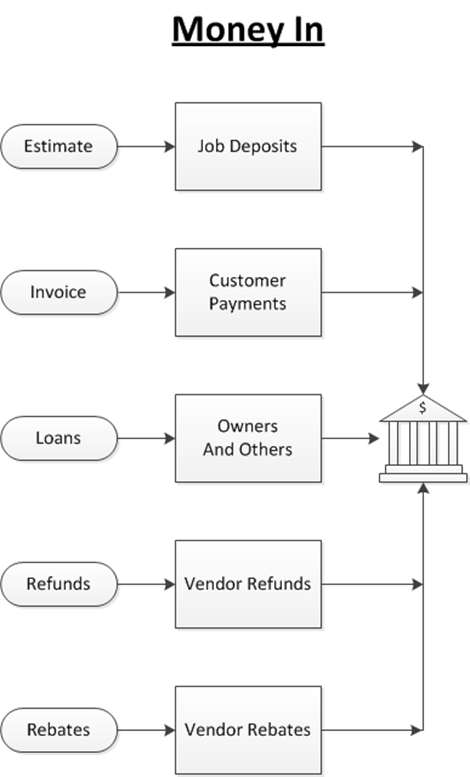

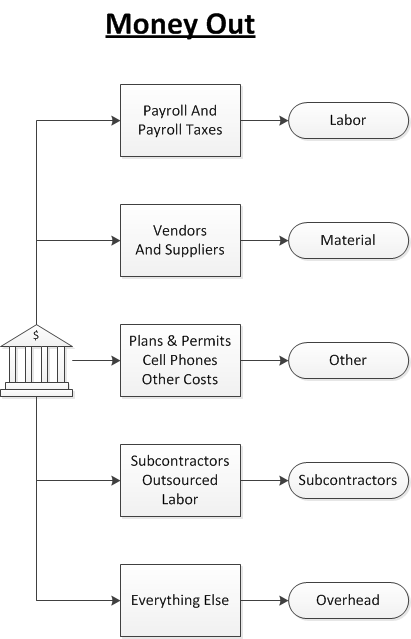

The bank only knows what has been deposited, what has cleared and the balance left in the account. Without an accounting system that tracks all of the income and expenses, How Do You Know? It is easy to put everything on Auto Pay and forget it.

Unfortunately, your clients have higher expectations and may not be willing to pay you based on when your auto-pays will be coming out of the checking account. Throw enough money in the checkbook, and everything will be ok – Right?

In the short term, all is great. It is called “Robbing Peter To Pay Paul.” In other words, you are paying yesterday’s bills with tomorrow’s money. This works perfectly when the economy is booming, and work is plentiful. You can take that job deposit and go to the nearest Truck Dealership and buy a New Truck.

Money is coming in fast like a spring thaw; no end in sight. No big deal with supplier bills or subcontractor being paid twice. There is enough money for everyone.

Unfortunately, that was not the way it works forever. Outside forces can cause the world of Construction to go from a Boom to a Bust in minutes, and recovery usually takes longer than a few days.

For Example

Weather related Floods, Hurricanes, Earthquakes, Avalanches, Mud Slides, No Snow, Too Much Snow. Bridges crash for a variety of reason. All of these things can cause Major Interstates to be closed.

Other economic factors can cause businesses to lay off workers or close. High fuel prices and everyone stays home. I remember waiting in Long Lines to be able to “get gas.” Your day depended on the last digit of your license plate. About that same time, it seemed like Houston, Texas would be a “ghost town” forever.

In 1971 there was a billboard in Seattle and had “Would the last person leaving SEATTLE - Turn out the lights” and look at it now. Downtown is dense, full of skyscrapers, building projects everywhere and lots of traffic.

Construction Contractors Face Challenges of Feast and Famine Depending On Your Local Area

The last few years in many areas of the country has been extremely tough on Construction Contractors. Some areas became the New Boom Towns while other areas declined or stayed the same (no growth and limited decline)

- Contractors adapted what they did, and whom they worked for and survived.

- Contractors were financially able to close shop and weather the storm.

- Contractors went back to work as employees of other contractors

- Contractors changed professions

- Contractors changed lifestyles

- Contractors retired

The economy is picking up in many areas of the country the need for contractor bookkeeping increases.

Contractors are going back to work. Able to charge reasonable prices (versus cutting bids just to keep working) For a long time; it was very depressing for Contractors to look at numbers when they know there is limited money for personal.

All income going back into the business in the form of tools, trucks, equipment and material for the job:

- Hoping the get by without any major truck breakdowns.

- Hoping that the weather would be good and the jobs would keep coming in.

- Hoping to get back to the part of Construction the Contractor likes to do and not just what it takes to keep going.

- Many contractors took on additional businesses or business types just to be able to keep going

- Many of these 2nd and 3rd businesses were not directly related to their primary business.

- They found a “Need” and “Filled It” and made a little extra money along the way.

- Most New Construction Builders do not want to do a Custom Home Project

- Most Custom Home Builders do not want to do Large Additional Projects

- Most General Contractors do not want to do Small Remodel Projects

- Most Remodel Contractors do not want to do Handyman Projects

- Most Trade Contractors do not want to do more then (1) trades unless it is related.

The Common trait is the “Contractor Did What Was Needed To Provide For Their Family.”

Contractors did their own bookkeeping. Spouses helped with Bookkeeping, Paying Bills, and Answering Phone.

Many spouses are “self-taught” because it didn’t matter if the training was available; there was No Money.

Now both Contractors and their Spouses want to know:

- Are We Making Money Or Losing Money?

- Is that “5 Cents” in the checkbook Our Money to spend as we please?

- Is that “5 Cents” in the checkbook already spent and the check has not been entered?

- Is that “5 Cents” due to a supplier or for some other bill coming I don’t know about yet?

- Does the “5 Cents” belong to The Government (Local, State, Federal) in taxes I don’t know about?

We Are Here To Help – We Know What To Do – You Do Not Need To Train Us To Do Our Job

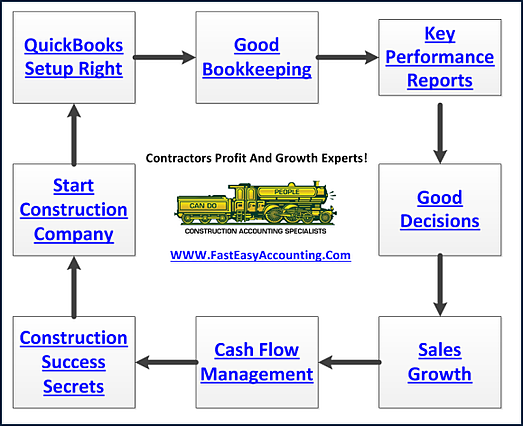

We have a Customized Setup for the QuickBooks Desktop Version and process that make it simple for you to come on-board. We know what works.

Our System Is A We Process- As the Client, you still do the parts that only you can (and should do) Meet Your Customers, Create Bids, Create Invoices, Collect The Money, Pay The Bills.

Our Part - Putting all those Transactions in QuickBooks in a way that produces useful reports for You and Your Tax Accountant. Your Tax Accountant looks at your numbers (1) day per year.

You Part - Is you have to live The Good, The Bad, and The Ugly and all their consequences the other 364 days of the year. As a Contractor, you have to make decisions every day.

We Are Here To Help - We Know What You Need and Why You Need It.

Starting Where You Are Now

- We can clean up your QuickBooks file (Desktop Version) and get it current.

Starting With Yesterday

- We can clean up your QuickBooks file going back as many years as you want.

Looking At Tomorrow

- We can provide Ongoing Bookkeeping Services.

- Part of that service is reconciling the checkbook, entering invoices, receiving payment.

- All of these things (and more) lead to having good Financial Reports.

With better QuickBooks Reports, you can make better decisions. Have More Time to do the things you want to do with your Life, Family, and Friends.

Looking Forward To Getting Started

Enjoy Your Day.

Sharie

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar