Construction companies are facing exceptional levels of uncertainty. With the novel coronavirus still spreading, varying levels of economic restrictions in place, and with national elections weeks away, contractors are desperate for signs of how demand for projects will vary by region and type of structure. Equally important are the prospects for supply-chain disruptions, materials prices, and availability of employees, subcontractors and government workers needed to approve projects.

Fortunately, this uncertainty and confusion is occurring at a time when there is more data available about the current state of the industry, and the overall economy, than ever before.

This flood of data is coming from multiple sources, public and private, and is giving contractors greater, and more immediate, insights into the state of the industry and how covid-19 is impacting demand and operations. While none of this data can predict the future, it gives contractors far greater — and more timely — insights into market conditions that will facilitate making key decisions about whether to make new capital investments, how many workers to employ and which market segments to pursue or flee.

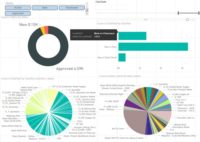

Available data includes well-publicized public statistics from sources like the federal Bureau of Labor Statistics, the U.S. Census Bureau, the Federal Reserve’s “Beige Book,” and other surveys. For example, the Census Bureau’s monthly construction spending data gives contractors a good idea of which market segments are seeing a surge in demand, and which are lagging. State and metro area construction employment data from BLS offers key insights into where demand is robust, while the agency’s producer price indexes provide signals regarding contractors’ costs and pricing.

Supplementing this public data are a host of survey results collected and analyzed by organizations like the Associated General Contractors of America. These surveys offer contractors an opportunity to gauge their peers’ expectations for labor needs, outlook for the coming year, how federal measures like the Paycheck Protection Program are impacting construction employment and what kinds of technologies firms are using to become more efficient.

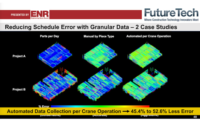

One of the side effects of the widespread adoption of new software and construction technology is the growing inventory of privately sourced construction data that offers the kind of up-to-the minute, granular data that economists who follow the industry have long hoped for. Software that tracks hours worked and project financial transactions provides weekly insight into levels of construction activity by market, project type or size of firm, for example. Meanwhile, information collected from sources such as drones, construction cameras and other sensors, and on-site documentation allows the industry to track how construction practices are evolving to address covid-safety protocols and other changes.

This new private sector construction data from firms like Procore, OxBlue, Smartvid.io, Multivista, and others is expanding the granularity and specificity of data available to construction industry leaders. And we understand that these companies are committing to working together to help validate their respective insights and provide the industry with near-real-time information.

In May, Procore began publishing data-driven insights on recent construction jobsite activity in the U.S. compared to pre-covid-19 levels. Looking at similar benchmarks, OxBlue publishes a regular state-by-state and national construction activity report using its artificial intelligence (AI) tools, and Smartvid.io has been publishing national covid-19 benchmarks for social distancing and mask wearing behaviors for workers by region in a covid-19 safety compliance report since the end of June. Recently, Multivista began reporting on the shifting usage patterns for its online construction documentation platform as they’ve seen clients increasingly rely on remote-based management workflow processes.

Combined with already available public data and survey analyses from associations and other groups, the new information is giving executives access to greater insight into current market conditions than they have ever before had. At a time when the industry is shrouded in uncertainty, having access to so much real-time and trend data will make it much easier for contractors to benchmark their responses today and to plan for the future.

Ken Simonson is the chief economist of the Associated General Contractors of America in Washington, DC.

Post a comment to this article

Report Abusive Comment