By Dale Stroud, Housing Authority

Sometimes, things are hard to believe. Take time, for example. Often, time seems like little more than a blur. It just goes by so quickly. Things that we sometimes think just happened actually occurred much longer ago.

Think about this: It has been almost a decade since the “Great Recession” ended! Hard to believe.

According to the National Bureau of Economic Research, the recession began in December 2007 and 19 months later was over at the end of June 2009 — thus, ending nearly 10 years ago. However, for many, it may not seem that it actually ended in mid-2009 because, for them, both the recession itself and the subsequent recovery have been long and difficult. Many still bear scars from the effects of that economic meltdown that brought our country nearly to its knees.

On the other hand, some aspects of the post-recession recovery have been truly remarkable:

- over 20 million new jobs have been created;

- unemployment is near an all-time low;

- stock prices have more than tripled;

- GDP growth has been good; and

- thousands of new businesses have been formed.

Add in the fact that consumer confidence is near a 10-year high — meaning people are willing to spend and participate in the growth of our economy. Put these and other upsides together, and you can begin to paint a pretty positive picture.

What about new housing?

And let’s not forget the all-important new housing market: It too must be booming!

Indeed, house prices have rebounded from the recessionary doldrums, mortgage rates are still affordable, financing is generally available, the vacant-home situation from the foreclosure crisis is mostly gone, and there are even housing shortages in some areas of the country.

But despite these and many other seemingly positive factors, the new-housing market, when viewed on a national basis, is NOT back to “normal.” It’s still trying to recover from the crash that occurred because of the recession. Hard to believe.

Let’s consider some history.

For the 10-year period preceding the start of the recession, annual housing starts averaged 1.72 million per year; in the five years preceding the recession, 1.8 million. Compare that with the long-term average, as calculated by the number of annual starts in the 50 years prior to the recession (national housing starts were first tracked beginning in 1959): about 1.5 million starts per year.

Not surprisingly, that 50-year average is the number of annual starts that housing experts say are needed, on average over time, to satisfy demand. In other words, for the years leading into the recession, it can be argued that we were building more houses than demographic-driven demand actually required. As a result, an inventory of unsold new homes was created for which, in many cases, there was no need. A surplus of dwellings was created.

It was a time of easy money and a lot of speculative house-buying took place. Many people were buying houses they truly couldn’t afford or actually need!

As it has since been described, a “housing bubble” of unneeded new homes was created that, in many respects, was ultimately one of the primary triggers for the start of the Great Recession. All bubbles eventually burst, and this one was no exception, sending the new-housing market into a steep downward spiral. The market finally “bottomed out,” in 2009, at 554,000 starts, or about 30 percent of the pre-recession level.

By now, nearly ten years later, you would think that we would be back to building houses in numbers that at least equate to that 1.5 million “sustainable” level. But we’re not!

Again, it’s hard to believe.

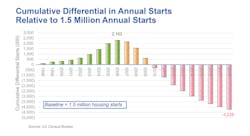

In the hole, four million starts?

Statistics from the U.S. Census Bureau show that there were 1.2499 million new housing starts in the U.S. in 2018: 875,800 were single-family homes and 374,100 multi-family units. And 2018 was the high mark for starts in the post-recession era! In the 10 years since the end of the recession, cumulative starts totaled just over 9.2 million, for an annual average of 920,000 — well under the 1.5 million per year needed, in theory, to meet demand.

On the other hand, as stated previously, in the five years prior to the recession, annual starts averaged 1.80 million, resulting in a cumulative “surplus” above the 1.5 million per year level. As a result, the calculated pre-recession surplus of new homes has now been more than eliminated by the low level of post-recession building.

In fact, when you “simply” compare the pre-recession surplus with the deficit generated during the recession and the post-recessionary period — i.e., subtract the deficit from the surplus — it is possible to conclude that, over the past 20 years, we have accumulated a “shortage” that could theoretically be as high as four million new homes! In other words, the quantity of homes NOT built since the recession far out-numbers the excess number built prior to the recession.

Far more conservative methods of calculating the deficit still put the shortage at between one-half and one-million housing units. So, whether the number is one-half million or four million, there is a recognized shortage of new homes.

Hard to believe.

Is there really a shortage of homes?

So why aren’t we back to normal? For starters, we should consider whether there truly is a shortage. Or is it in theory only?

It’s not an easy question to answer. Understanding the true demand for new homes is a rather complex puzzle. A number of big-picture factors must be taken into account, including:

- overall population growth;

- household formations;

- housing vacancies;

- net immigration;

- conversion of existing structures into housing units;

- demolitions of dwellings (both intentional and unintentional); and

- the purchase of “second” homes.

In addition, some “softer” considerations come into play:

- the desire/intent to own a home;

- generational preferences; and

- life-style effects.

Housing vacancies and household formations, in particular, deserve a little more attention.

Housing vacancies: The pre-recession overbuilding of housing that resulted in homes never being occupied, coupled with the foreclosure crisis that developed during the recession and lasted well into the recovery period, together created a very large surplus of vacant homes. Thus, those vacancies helped provide a supply of homes needed to fill demand during the period of relatively depressed new-home building during the post-recession era.

As such, we have temporarily been able to overcome — partially — the low level of new-home building through the occupation of previously vacant dwellings. Housing vacancies are now almost 2 million units lower than during the recessionary peak, according to estimates from the U.S. Census Bureau.

Household formations: During the recession and the early stages of the recovery, household formations were low. It’s not that people were not reaching the stage of life when home-ownership or rental typically takes place, not striking out on their own, or not getting married. Instead, Americans were not actually forming new households.

In other words, rather than embarking on ownership or rental of a home, many people were “house-sharing”: adult children living with parents, siblings with siblings, parents with children, families with families, roommates with roommates, and other possible combinations and living arrangements. Thus, during that period of low household formation, the demand for housing was unusually low.

Over the past few years, household formations have returned to more “normal” level. According to proprietary analysis by Zelman & Associates, household formations were 1.29 million in 2018, thus nearly back to pre-recession levels—but with softness persisting, so additional improvement is possibleAlso, some other studiesshow that household formations among younger adults is still lagging, and, as a result, some of the alternative living accommodations mentioned above are still prevalent for that age group. Nonetheless, between a decrease in vacant housing and an increase in household formations, one would think that demand for new housing would be robust, and housing starts would, at minimum, be back at normal. We should be on the cusp of a boom in new-home construction!

But, it appears that we are not — at least yet. In fact, some data shows that we are actually in the midst of a slowdown in new-home construction and new-home sales. For example, through the month of March, housing starts, on a year-to-date cumulative basis are about 9 percent lower in 2019 than they were for the same period in 2018; and, in the same type of year-over-year comparison, permits are down 5.4 percent. Though sales of new homes have recently ticked up, the trend over the past 15 months has shown no growth in new home sales. Further, optimism on the part of new-home builders has recently declined (albeit from high levels). Together, these factors indicate that growth in new-home construction may be taking a temporary “pause.”

Again, hard to believe.

What’s Housing Hold-up?

What is going on? Demand should be high but, for nearly 10 years now, we have not been building a “sustainable” number of new homes needed to meet that demand. Things don’t seem to add up.

Some contributing factors to this apparent dichotomy that various market observers have put forth are:

- Affordability: The number of median income families who can afford to buy a house is at a ten-year low, according to the National Association of Home Builders (NAHB). Only 57 percent of median income families can now truly afford to purchase a home. Furthermore, in many parts of the country, the price of new homes is higher than in the pre-recession era, thus affecting affordability for all ranges of family income.

- Shortage of skilled labor: Like many industries, home builders are having significant problems in finding the number of workers needed to build their homes. The number of workers in the construction field is NOT yet back to pre-recession levels, according to data from the U.S. Bureau of Labor Standards (BLS).

- Cost of building materials: Though cost increases of building materials have moderated, a recent survey by the National Association of Home Builders indicates that the cost of building materials is the second-greatest concern now faced by builders (with labor being the first).

- Mortgage rates concerns: Rates have recently moderated, but they are up from levels of two and three years ago and are a limiting factor for some prospective home owners. Although mortgage rates remain low from a historical perspective, any possible interest-rate increases could put them in a range that an entire generation of home buyers never previously experienced.

- Student debt: Many younger, prospective home buyers are saddled with high levels of debt from financing their college educations; thus, limiting their ability to acquire a down payment for a new-home purchase. According to Forbes, the cumulative student loan debt for 44 million borrowers now totals $1.5 trillion. In addition, debt due to car loans is affecting the cash flow of many potential home buyers.

- Not enough “starter” homes: In many parts of the country, there is an insufficient supply of starter homes for first-time buyers; thus, making it difficult for those prospective buyers to find a house that fits their needs and their budgets.

- Lack of developed land: In some area of the country, shovel-ready tracts of land or vacant lots are not readily available. Hence, builders and developers must first acquire and prepare land and put in place the necessary infrastructure before construction of homes can begin.

- The rise of urbanization: The ongoing trend to urbanize, rather than “suburbanize,” means that many existing urban, nonresidential structures are being converted into housing. Also, conversion of existing, single-family homes into duplexes (or more) is occurring. Such conversions supplement new-home construction and, in a sense, negate the need for new-home building.

- Manufactured homes are taking up some of the slack in new site-build home building: About 96,500 manufactured homes were built in 2018, a 60% increase since 2013, according to the Manufactured Housing Institute (MHI). Thus, manufactured homes were built at a level equal to about 10.5 percent of new stick-build single-family homes. (Manufactured homes are not accounted for in new-home-start statistics, but are additive to the total available new housing.)

Fortunately, none of the above considerations, by itself, is an impediment to a more robust housing market. Even when taken collectively, they do not negate the underlying need to build more new homes. Further, most of the above considerations are somewhere in a “state of repair” that, as the mending process takes effect, will increasingly diminish their possible negative effect on the market.

Okay, so it’s still an open question: When will new housing starts be back to “normal”?

The 1.2499 million starts that we had in 2018 was simply NOT normal when viewed in the larger context of longer-term need for new housing; i.e., that sustainable level of 1.5 million starts annually. When you sort out all of the “ifs, maybes, and buts” outlined above, it appears that new-home building may, indeed, be in a temporary pause, but NOT a severe or ongoing decline. We are not about to burst a bubble again!

Yes, there is a chance that starts in 2019 might actually be no greater than 2018, which, if so, would mark the first time in the post-recession period that starts will not have a year-over-year increase. However, normal market forces dictate that we must eventually build more new homes — and, we hope, sooner than later.

Thus, it is highly likely that in three of the next four years, we will — barring a possible recession — re-attain the sustainable 1.5 million annual start level, and then even surpass that amount in subsequent years.

Hard to believe? No, it’s actually quite believable.

Dale Stroud is a business advisor to Uponor, Inc., a consulting role that he has held since recently retiring from Uponor after a 16+ year career. While full-time at Uponor, he held various senior management roles in the marketing and offering functions. Stroud is also a professional member of the Plastic Pipe & Fitting Association (PPFA) and the Plastics Pipe Institute (PPI). He is a past-member of National Association of Business Economics (NABE). He can be reached at [email protected].