There are over 1,400 large-scale rental apartment projects under construction in the biggest metros in the U.S. In buildings that will have 50 or more apartments, 321,177 units are projected to be completed by year’s end, representing a 50% increase over the 214,108 completions in 50-plus-unit structures in 2015, according to RENTCafé, a nationwide apartment search website.

This is the highest point for apartment construction in the past five years.

Apartment construction in the country's 50 largest metros is the highest it's been in five years. But with so much new inventory coming on line, rent appreciation has slowed in several of these markets. Image: RENTCafe

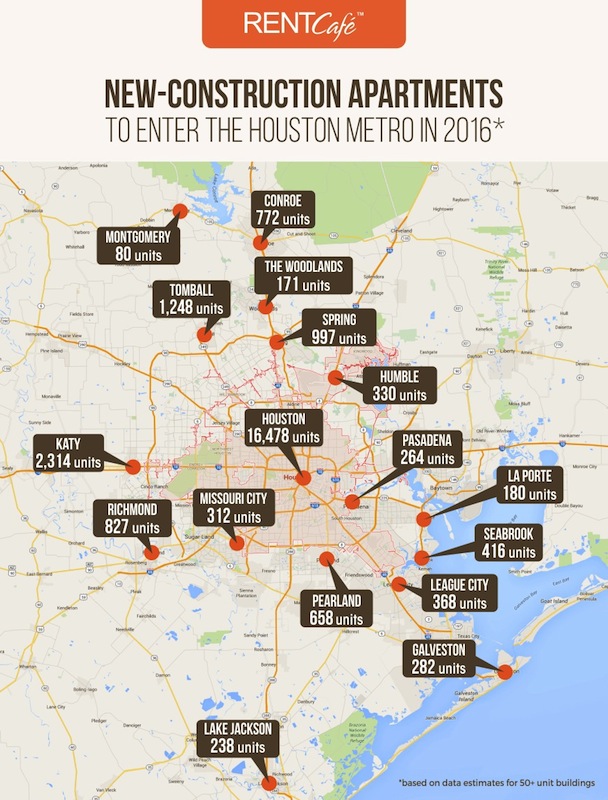

Drawing from data captured by its sister company, Yardi Matrix, RENTCafé examined the construction pipelines in the country’s 50 largest U.S. markets. It found that two Texas cities—Houston and Dallas—rank first and second among the top 20 hottest metros for apartment construction. Houston expects to deliver 25,935 apartment units in 95 developments this year. That total includes Tate at Tanglewood, which will add 417 units to Houston’s Galleria/Uptown submarket.

Greater Houston is expected to have nearly 26,000 new apartment deliveries this year. Texas's four largest metros combined should add 69,000 units. Image: RENTCafe

RENTCafé estimates that more than 69,000 new apartments will be delivered in Texas’s four largest cities, Houston, Dallas, Austin, and San Antonio, representing 22% of the total estimated increase in inventory within the 50 largest metros that include New York (21,177 deliveries), Los Angeles (20,205), and Washington D.C. (18,027).

One-bedroom apartments will account for more than half (51%) of the new rental stock that comes online this year. RENTCafé indicates that studio apartments rank lowest on developers’ preferences for bedroom distribution, whereas two-bedroom apartments are expected to account for 37.5% of new deliveries.

RENTCafé attributes low inventory levels and increased demand as the drivers of this construction boom. However, it cautions that “the plethora of new rental units coming online may finally turn the tables in the renters’ favor: where there’s choice, there’s competition and, in this case, competition translates into concessions, lower rents, and a more-relaxed housing landscape in general.”

The website points out that while average rents are at all-time highs, rent growth slowed in 2015 to 5.6%, and is projected to increase by only 4.4% this year.

RENTCafé also notes that hot rental markets like Washington D.C. have cooled over the past year. The city proper will see about 5,100 new apartment units this year, “furthering the prospect of an even more relaxed housing market in the future.”

In this competitive environment, rental properties are attracting tenants with deals and incentives. For example, JOYA, a 431-unit community under construction in Miami, has reduced its rates and is offering a rent-free month. Its amenities include a 3,000-sf 24-hour fitness center, a yoga studio, resident-reserved garage parking, and a resort-style pool.

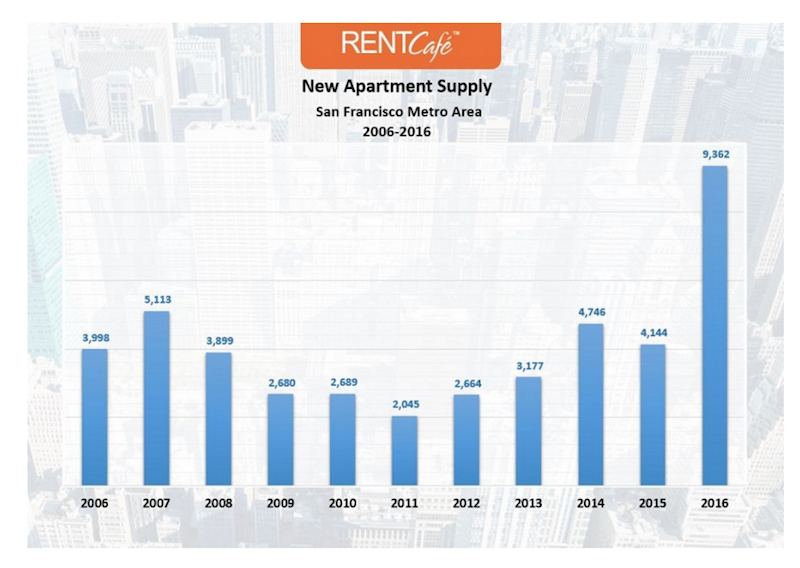

That being said, RENTCafé expects Dallas to remain a hot rental market primarily because of its nearly 4% annual employment growth rate. In pricey San Francisco, nearly 9,500 apartment units are projected to be added this year, a 125% increase over 2015 completions, which could eventually provide some much-needed rent relief. (The average monthly rent in San Francisco is expected to rise by 8% to $2,469 this year.)

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

In other markets, like Sacramento, Portland, Ore., and Seattle, apartment construction still isn’t keeping up with demand.

It would appear that the country’s 50 largest markets are where the bulk of new-apartment construction is occurring. The Census Bureau estimated that, in June, apartment completions in structures with five or more units were tracking nationally at an annualized rate of 386,000 units, a 21% increase over Census’s June 2015 estimate.

Related Stories

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.

Mixed-Use | Apr 13, 2024

Former industrial marina gets adaptive reuse treatment

At its core, adaptive reuse is an active reimagining of the built environment in ways that serve the communities who use it. Successful adaptive reuse uncovers the latent potential in a place and uses it to meet people’s present needs.

MFPRO+ News | Apr 12, 2024

Legal cannabis has cities grappling with odor complaints

Relaxed pot laws have led to a backlash of complaints linked to the odor emitted from smoking and vaping. To date, 24 states have legalized or decriminalized marijuana and several others have made it available for medicinal use.

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.

MFPRO+ News | Apr 10, 2024

5 key design trends shaping tomorrow’s rental apartments

The multifamily landscape is ever-evolving as changing demographics, health concerns, and work patterns shape what tenants are looking for in their next home.

Mixed-Use | Apr 9, 2024

A surging master-planned community in Utah gets its own entertainment district

Since its construction began two decades ago, Daybreak, the 4,100-acre master-planned community in South Jordan, Utah, has been a catalyst and model for regional growth. The latest addition is a 200-acre mixed-use entertainment district that will serve as a walkable and bikeable neighborhood within the community, anchored by a minor-league baseball park and a cinema/entertainment complex.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.