Increasing cash flow and profits in your Construction Company is a process that can be predictable and profitable. "If you know the answers; the questions will not bother you" - Randalism.

In school when you sat for an exam or a test and if you understood the material backwards, forwards and sideways the test was fast and easy. The exams and tests for the classes you struggled with were the ones you did not study for most likely, because you did not enjoy the material.

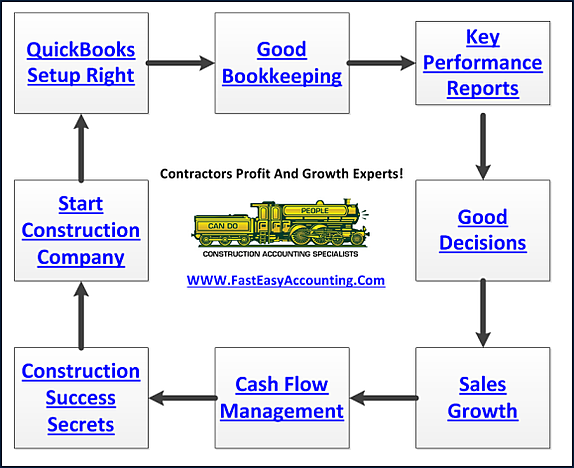

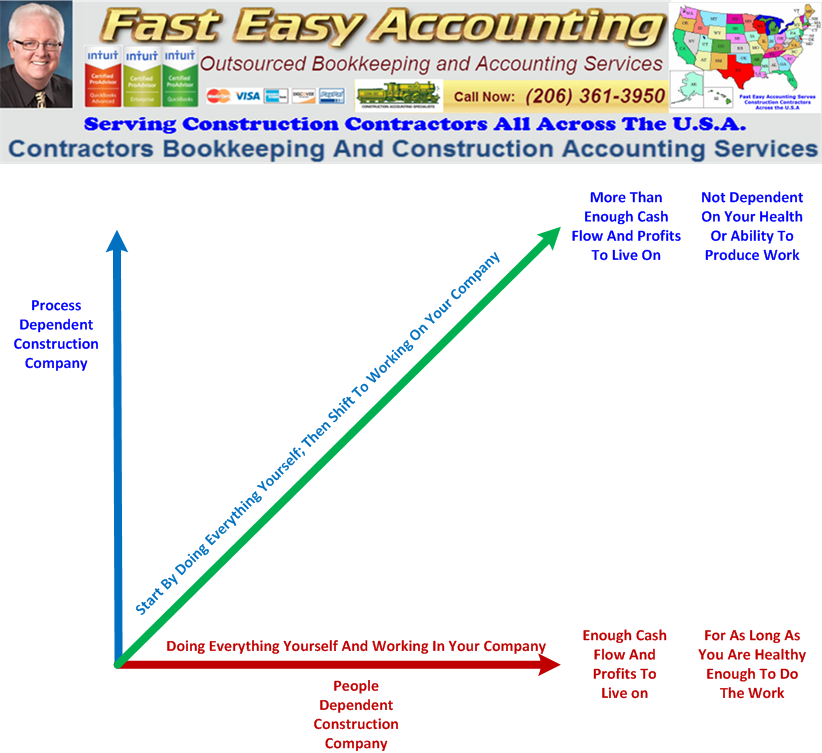

Successful contractors love working on their Construction Company, not in it. They get a lot of pleasure from developing and implementing effective and efficient business strategies. There are a number of effective strategies and I invite you to take a look at our Contractors Success M.A.P.

It is FREE and designed for owners of small construction companies who have 1-20 employees and under $10M a year in sales volume. It is a compilation of articles, Podcasts and a list of Books we recommend you add to your personal library.

Successful contractors find ways to leverage their limited time, money and effort to make as much money as possible in the shortest amount of time and you can too. Let me share some of their secrets with you.

Practically every small construction company owner like you and I started by doing everything ourselves because there isn't enough time, money and resources including trucks, vans, tools and equipment to hire anyone. Nowadays you outsource quite a lot without even thinking about it; however, this was not always the case. Here are the first three examples where highly profitable contractors leveraged their time and generated a lot of money in the early days when these innovations were first introduced:

- Cell Phone Service

- Oil Change Service

- Merchant Service

Successful High Profit Contractors Embrace Innovation

Before Low Profit Contractors Know It Even Exists

Cell Phone Service

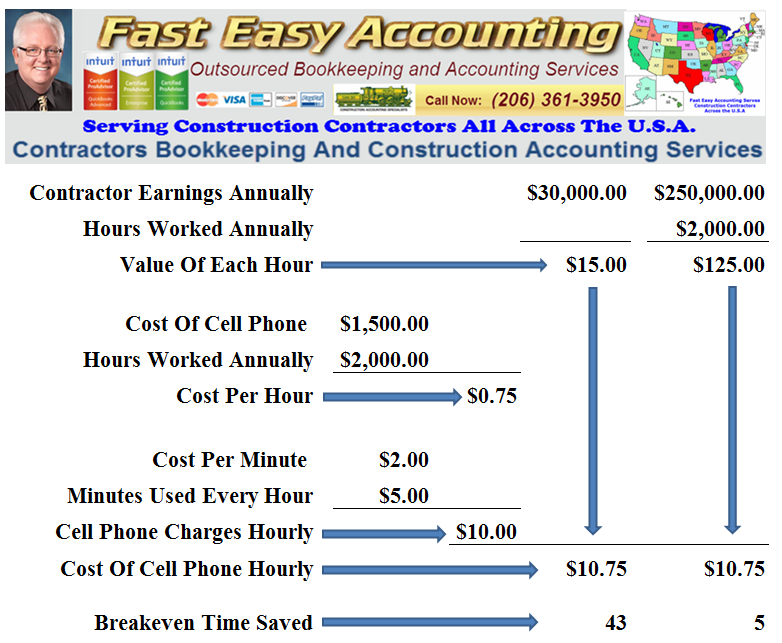

How many contractors bought a Motorola DynaTAC 8000X cell phone when they were first available in 1984 for $3,995? None of them; they waited until the early 1990's when the price came down to under $1,500 and the cost per minute was just under $2.00. Why you ask would anyone do that?

Time is money and if a contractor earning $30,000 a year could save 43 minutes every hour by not having to search for public pay phones, park and talk it made sense; however, most of them could not justify it so they did not do it. A contractor earning $250,000 a year could easily save 5 minutes an hour so it was a "No Brainer" for them to have a cell phone. The diagram below shows what happened in the early 1990's and why successful contractors embraced cell phones.

The terrible truth is the rich do in fact get richer because they go from Peak-To-Peak reaping economic profits from continually adapting to ever-changing markets and economic situations. They use basic math and have a strategy like our Contractors Success M.A.P. Poor contractors are forever playing catch-up because they hate change and will not embrace new innovations until everyone else is on board and all of the economic profits are gone and normal profits are the norm.

The only people that embrace change and want it are babies with soaking wet diapers! Everyone else hates change, especially high profit successful contractors. The only reason they embrace change is they know it is the only way to survive and thrive.

Oil Change Service

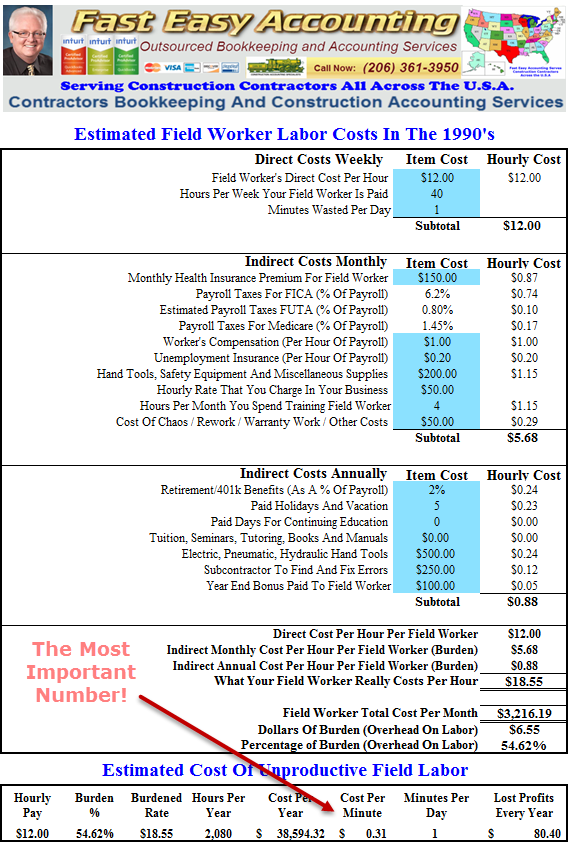

How many contractors started using the oil change services when they first appeared in the 1970's? The contractors who understood the value of time and what Ten Minutes Waste Costs. If they had a construction worker who was being paid $12.00 an hour at that time and if they knew how to calculate the fully burdened labor cost of that worker which would be approximately $0.31 a minute they would calculate the difference between Do-It-Yourself vs. Outsource it.

Cost of oil, filter = $10 + Labor (60 minutes to get the supplies, do the work, dispose of the dirty oil and filter and clean up X $0.31 = $18.60) = $28.60

Cost of oil change service = $21.95 + (15 minutes of worker's time X $4.65) = $24.60

Savings = $4.00 If the contractor earned net profit of 10% then changing the oil means having to sell and perform $40.00 of work to make up the loss. Not a lot of money until you consider this:

Success Is A Few Simple Disciplines Practiced Every Day

Failure Is A Few Simple Errors Repeated Every Day

Merchant Services

In the early 1990's banks began allowing mobile merchants to accept credit cards. We spent $3500 per terminal and paid processing fees amounting to 5% of each credit card sale. That meant for every $100 sale you got $95 and the banks kept the rest. Why you ask would anyone do that? Because it made us a ton of money! Whenever Marginal Revenue Exceeds Marginal Cost Do It! Click here for more on MR>MC.

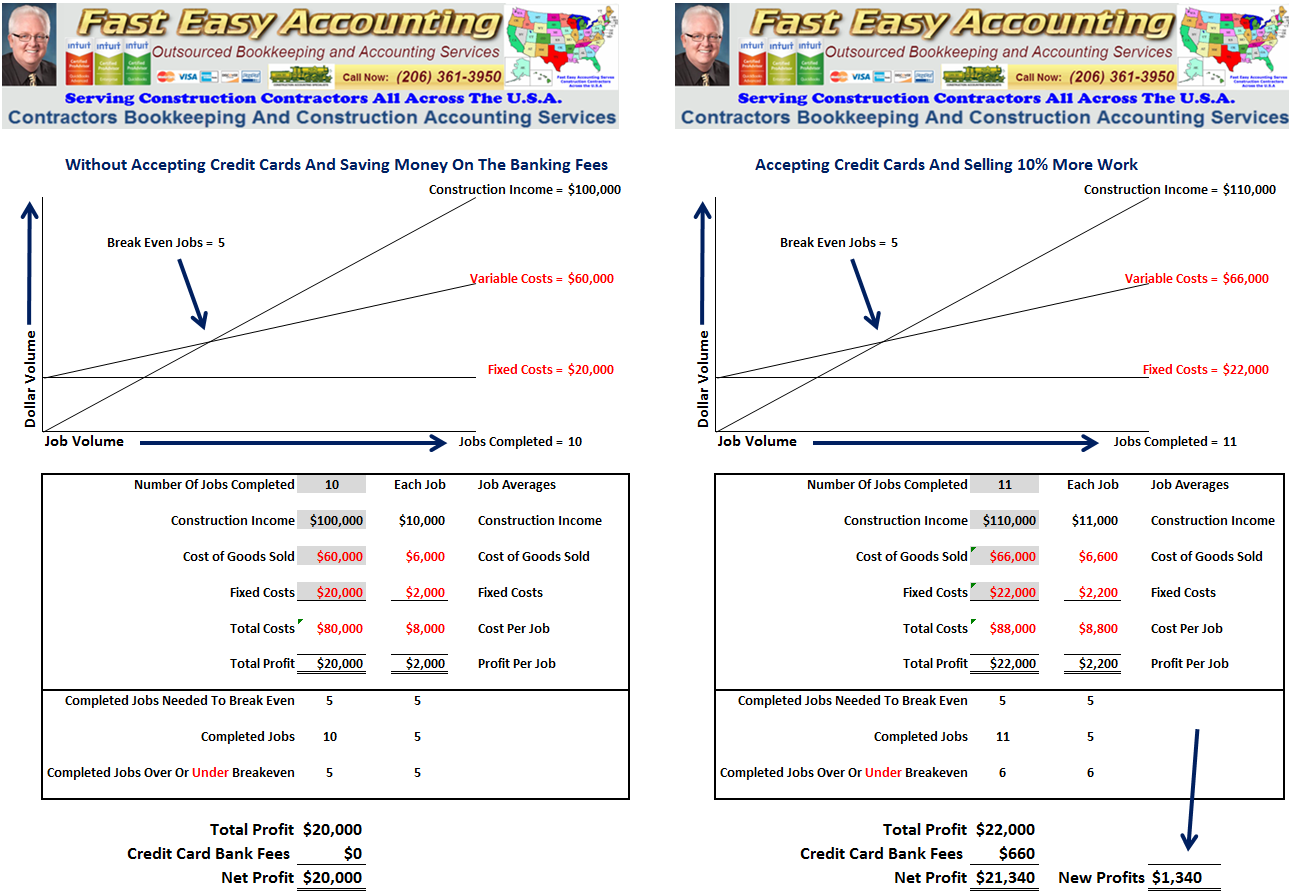

The diagram below shows an example of accepting credit cards generating 10% more in sales and after all of the costs the contractor could net an additional $1,340. Our experience is that we generated a lot more than 10% in new sales and accepting American Express was even higher yet.

We earned enough "new money" in less than 90 days to pay for terminal and the fees. How you ask? Simple, very few people paid with credit cards in those days and the ones that did always wanted more work done than they originally called us to do. We would arrive to make a minor repair and when our client realized they could pay with credit card they wanted to get everything on their "To-Do-List" fixed. Today it is a lot cheaper to accept credit cards and the profit potential is even greater.

Very quickly we purchased five terminals, one for each service truck. Whenever one of my competitors asked me why we were so wasting money and being ripped off by the banks I would just respond with "I am not the brightest bulb in the box, but we do O.K. financially". So well in fact, my bankers and financial advisors were pleased because our profits were always higher than the norm for a construction company, enough said. If you do not want to accept credit cards that is O.K. because you need to do what is right for you.

The Fourth Innovation Is Catching On Rather Slowly

But More Contractors Are Getting Onboard Every Day

Contractor Bookkeeping Services

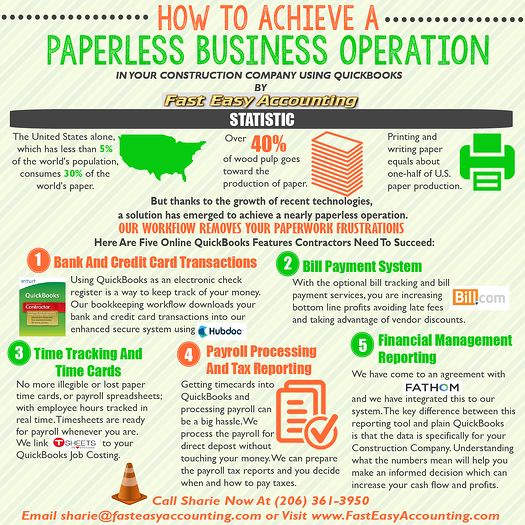

These days, contractors are under increased pressure to cut their prices to get enough work. And that means they need to reduce costs. New technologies and new approaches in cloud computing for construction accounting gives forward thinking contractors an amazing ability to get more for less - but in most cases, contractor's heads are still stuck in 1990, thinking they have to do everything themselves.

Regular bookkeeping and nailing two boards together is easy and just about anybody can do it. Building or remodeling a house or commercial space and doing construction bookkeeping is not so easy and nobody can do either one with less than 10,000 hours of training and practice. Too many contractors have found out the hard way at bankruptcy court and at the auction where their entire construction company is being sold for pennies on the dollar.

First, separate in your mind the concept of outsourcing contractor bookkeeping services and jobs because they are not the same thing. For example, suppose you decide to upgrade your contractor bookkeeping software from shoeboxes full of receipts or spreadsheets to a computer based construction accounting software like QuickBooks.

You can pay your bookkeeper to spend days or weeks trying to figure out how to setup QuickBooks for your construction company and in the end wonder why you don't have the Financial and Job Costing Reports you need to operate and grow your company, or you can outsource that task to someone who does it hundreds of times a year and add a few hours of tutoring for your in-house bookkeeper.

The result will be a QuickBooks file for construction that is designed to work the way you do and has a lot of memorized transactions, customized reports and accounts preset to handle things like:

-

Retention Tracking System

-

Insurance Audit Reports

-

Five Key Performance Indicator Reports for monitoring your business

The Difference Between Construction Accounting And Regular Accounting

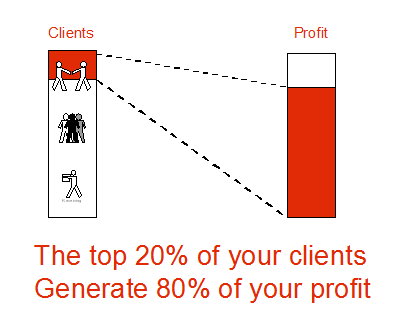

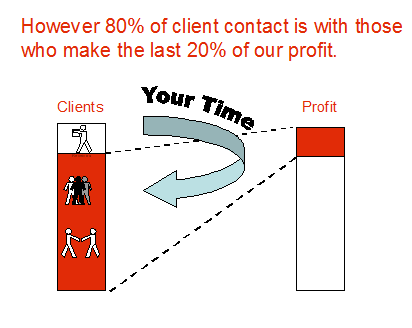

Construction Accounting is built on a foundation of regular accounting and shares the same basic financial reports for operating and growing a business and preparing annual tax returns and some very rudimentary management decisions. Construction accounting adds many complex layers of reporting mechanisms to show you, the contractor, where your best customers are within psychographic and geographic market segmentation boundaries using the 80/20 rule.

The 80/20 Rule Can Make You A Lot Of Money!

For example:

-

20% of your customers normally generate 80% of your net profit.

-

20% of the goods or services you sell contribute 80% of your revenue

-

20% or 2 out of 10 of your staff create 80% of the value for your customers.

The frightening consequence of the 80/20 rule is that 8 out of 10 hours we spend at work drive almost no value to the bottom line and the biggest drain is trying to save money doing our own contractor bookkeeping instead of reviewing the Key Performance Indicator (KPI) Reports. Through our contractors bookkeeping services system you can access them 24/7 without opening QuickBooks for Contractors.

The frightening consequence of the 80/20 rule is that 8 out of 10 hours we spend at work drive almost no value to the bottom line and the biggest drain is trying to save money doing our own contractor bookkeeping instead of reviewing the Key Performance Indicator (KPI) Reports. Through our contractors bookkeeping services system you can access them 24/7 without opening QuickBooks for Contractors.

The most important value good bookkeeping brings to a business is an understanding of where your 20% is hidden. By generating daily reports that uncover the best customers, jobs, services, or products, you will soon see how you can refocus your internal efforts on doing more good work. This is the great contribution a company receives from good QuickBooks® data and from using QuickBooks® the ‘right-way’.

The most important value good bookkeeping brings to a business is an understanding of where your 20% is hidden. By generating daily reports that uncover the best customers, jobs, services, or products, you will soon see how you can refocus your internal efforts on doing more good work. This is the great contribution a company receives from good QuickBooks® data and from using QuickBooks® the ‘right-way’.

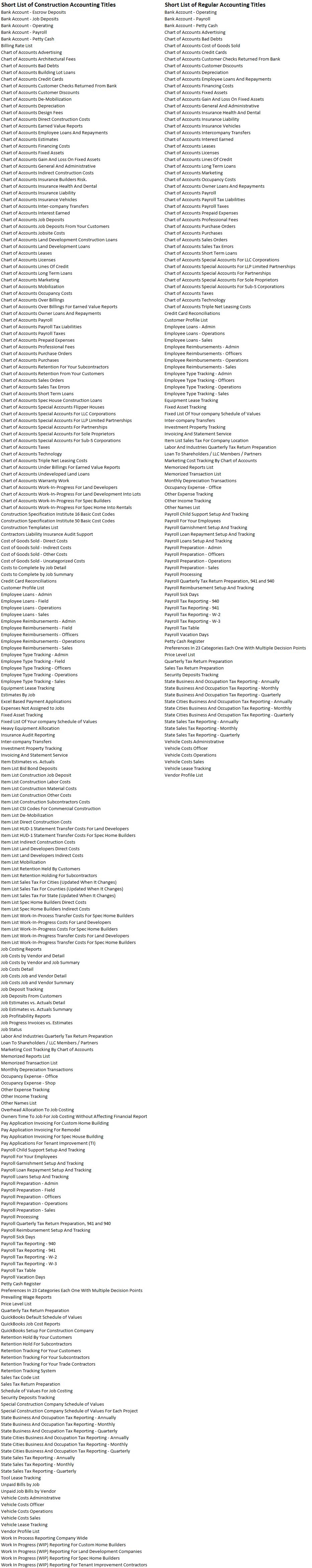

Below is a short list of the Chart of Accounts commonly used for construction accounting and regular accounting. The list is intentionally short in order to make the point without being completely overwhelming.

Construction Account = 233 Vs. Regular Accounting Titles = 115

So we’re not talking about jobs. When I say, “outsource your contractors bookkeeping” I do not mean turn it all over to us or any other contractors bookkeeping service because this is a something that never seems to work out well. No, I’m talking about outsourcing specific bookkeeping services related to data entry, bills, payroll processing and preparing Quarterly Tax Returns.

NEVER, EVER let an outsider pay the bills, print checks and authorize payment for payroll or any tax payments. It is crucial your keep control of your money. In fact outsourcing contractors bookkeeping is one of the ways to avoid bookkeeper embezzlement

My suggestion is to look at every part of your internal contractor bookkeeping service and ask yourself a simple question: is this a unique and critical part of our construction company and is it something that only we do? If so, it stays in-house, and needs the brightest minds you have working on it. If not, it is a candidate for outsourcing, and you need to look at it more closely.

I’m not suggesting “automatically outsource it,” because the decision isn’t that simple. This first question is just the starting point.

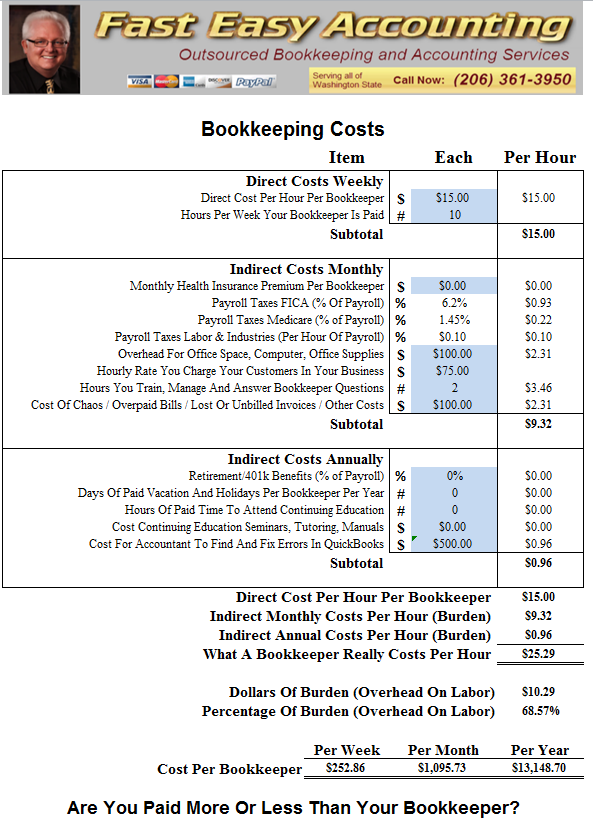

For example, bank and credit card account reconciliations in QuickBooks are what help maintain the accuracy and integrity of your Financial and Job Costing Reports. If you have two of each you are probably paying someone at least two hours a month to reconcile them. That person might make $15 dollars an hour and by the time you add overhead for labor burden they cost your construction company $25.29 an hour X 2 hours = $50.58 a month just to reconcile the bank and credit card statements. Unless they use Journal Entries to save time and destroy any hope of job costing reports.

Fully Burdened Bookkeeper Cost

Simply means what it will cost you to hire someone including the company portion of the payroll taxes and all those little costs that only an accountant like me would think about. The example below shows a part-time in-house bookkeeper at $15.00 an hour working 10 hours a week. Notice this poor soul does not have any benefits at all and they still cost the company $25.29 per hour!

These costs do not include heavy training for your bookkeeper; read The Nine Steps for more. The two happiest days in a construction company owner's life is the day he hires a bookkeeper and the day he outsources his bookkeeping.

Generally speaking we know from our research a typical contractor with 2-4 employees and annual sales of $500,000 will need at least a part-time bookkeeper for 10 hours a week and they will try to get away with only paying them $15.00 an hour plus overhead and it will cost their construction company approximately $13,000 - $15,000 a year and most of the time they will still overpay their taxes, have bad or non-existent financial and Job Costing Reports.

But you’d still need an in-house bookkeeper, right? Well… perhaps not. See, outsourcing is often interesting in that, while you still need administrative resources, they can be less skilled. They don’t need to have any contractors bookkeeping service skills to pick up the mail, make bank deposits, print checks, which can be done on your local computer even with QuickBooks Desktop version in the cloud. It’s likely a part-time office assistant could do that in addition to other duties and errands.

Point is, it is worth asking the question what are the things you and your employees should be dealing with that nobody else can do for you. Everything else - contractors bookkeeping services, cell phones, power, land lines for office phones, coffee service, janitorial services should be outsourced if possible, and if it makes sense. Not because it’s cheaper, although outsourcing often works out that way in a careful comparison. No, you do it because it removes distractions, so that everyone in your construction company can focus on what’s important to acquiring customers and satisfying their needs which puts money in your pocket.

It’s an interesting approach. The only reason more contractors haven’t started down this road is because most construction companies are poorly managed, which means they all kind of level out against each other. But, many contractors are figuring it out and wishing they had started years ago.

----------------------------------------------------------------------------------------------------------

General Contractor, Lynnwood Washington Review:

"The beginning of 2008 my company attempted to save money by doing our own accounting, but instead paperwork started piling up, wasn't organized and wasn't getting done. I failed to realize the amount of time and effort that went into accounting, especially not being an accountant by trade.

I didn't want to have my wife take on the burden being a stay-at-home home and already having her hands full with 2 kids so I made the decision to go back with Randal and Sharie. I am a new, young business owner and have sought much help from them and have always gotten great advice and great help.

They know the trade, and they know what I'm going through on a daily basis. I have not regretted my decision one bit. They have helped me to get back on track and get my business running smooth again. I am grateful for the services they offer.

I would recommend their services to any General Contractor." Click here to read more reveiws

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+