If You Want QuickBooks Financial And Job Costing Reports You Can Actually Use Maybe Someone Else Should Do It

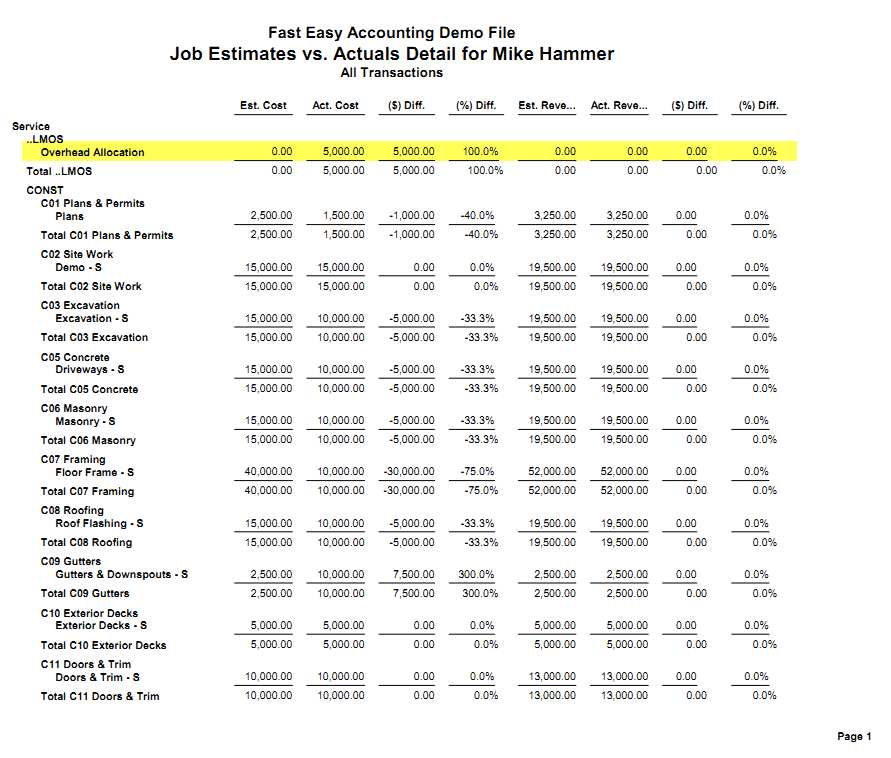

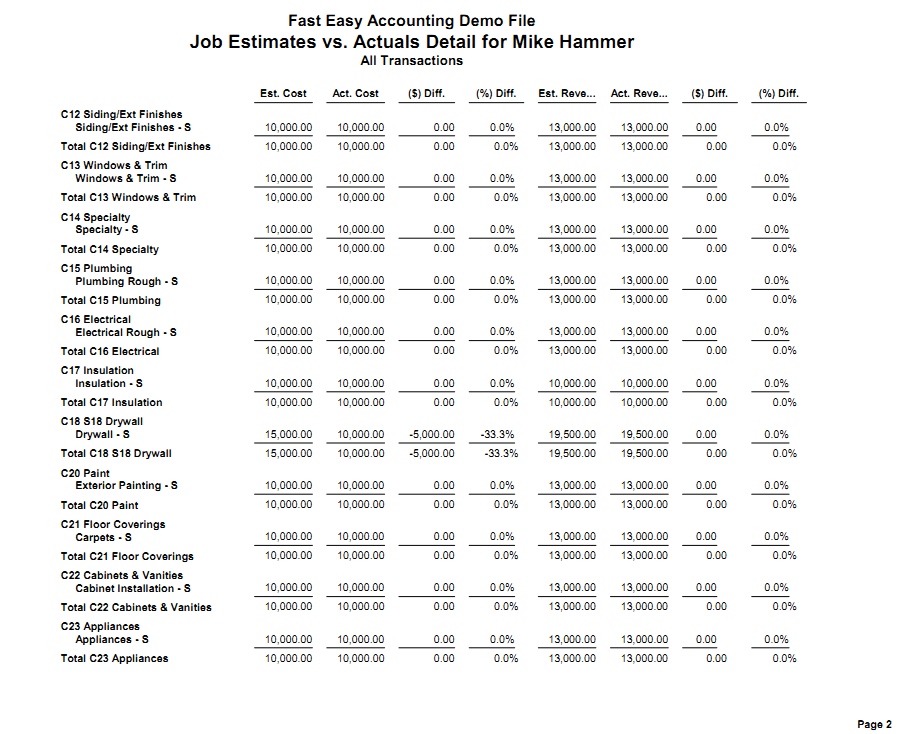

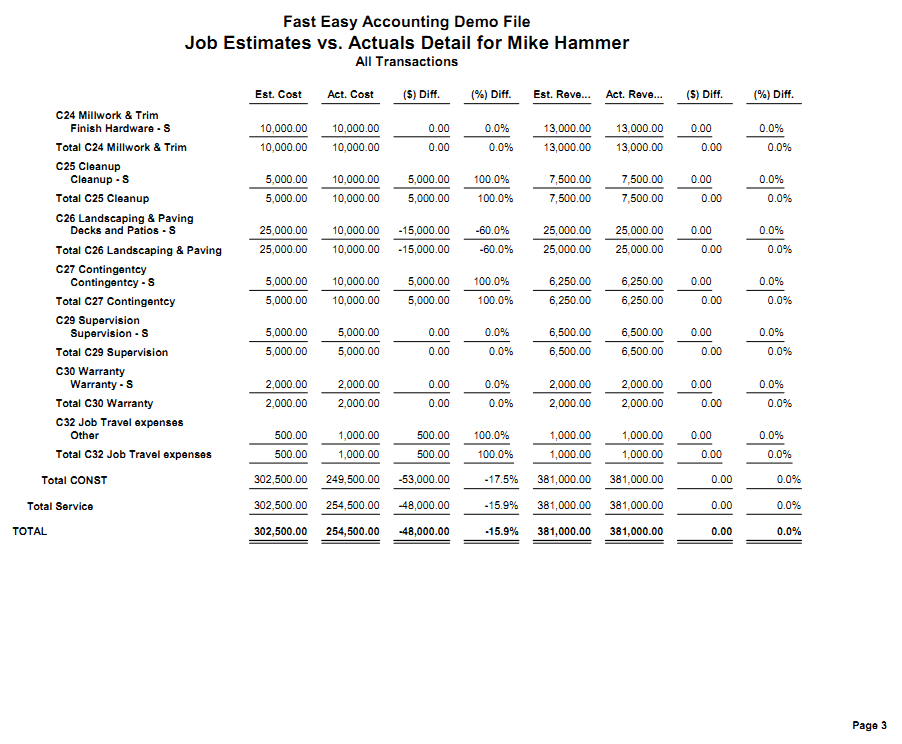

It Is Difficult To Make QuickBooks provide accurate Job Costing Reports with burden (Overhead Allocation as shown below) and generate accurate Estimates Vs. Actual reports. We have done it and it is a part of our comprehensive contractors bookkeeping system that we started developing over twenty years ago and the contractors we work with love it!

One Secret Is QuickBooks Setup For Construction. The Chart of Accounts and Item codes have to be designed to work the way contractors work and the accounting staff have to be trained in construction accounting methodology.

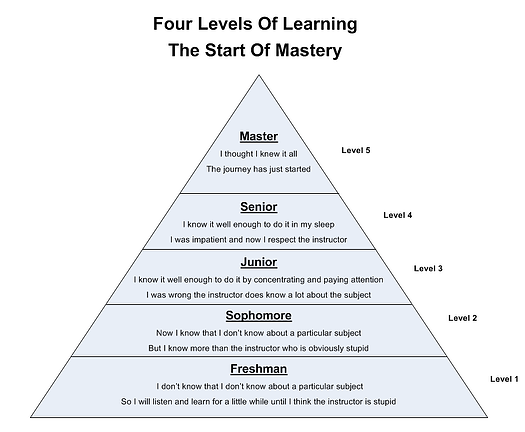

The Primary Obstacle is very few accountants and bookkeepers are trained in construction accounting and those who had invested the 10,000+ hours to become qualified accountants and then another 10,000+ hours to master construction accounting were offered high paying jobs with larger construction firms where they could earn $75,000+ benefits and expect to peak out over $150,000+ in a few years. After having gone through the entire process of The Four Levels Of Learning who could blame them for wanting to be paid what they are worth?

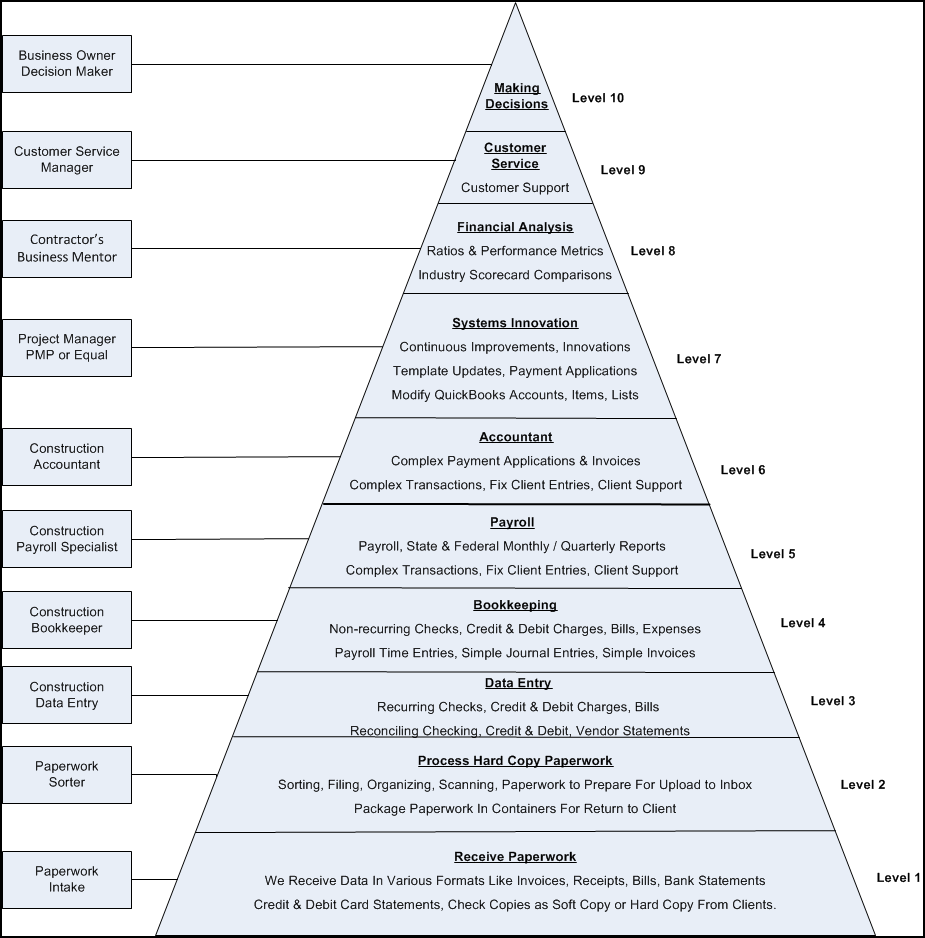

In 1991 We Began Working On A Construction Bookkeeping System to address this issue so that we could provide the services of a fully qualified master construction accounting professional by analyzing all of the skill sets required and breaking them into smaller manageable chunks.

In 1991 We Began Working On A Construction Bookkeeping System to address this issue so that we could provide the services of a fully qualified master construction accounting professional by analyzing all of the skill sets required and breaking them into smaller manageable chunks.

For more in depth information about hiring an in-house construction bookkeeper click on the button below to download the guide

For more in depth information about hiring a Contractors Bookkeeping Service click on the button below to download the guide

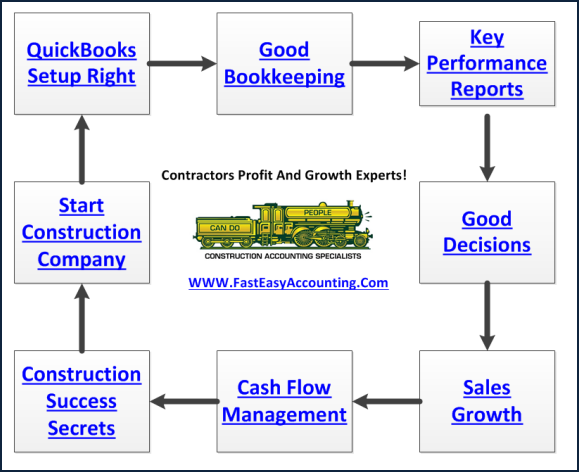

One Of The Keys To Success - Is intelligent delegation, relying on processes, not abdication, letting people do whatever they please. This means we have processes and procedures for how tasks are done, in what order similar to an assembly line. The table and diagram below shows how tasks are delegated to the lowest skill level and yet everything is reviewed by a competent accountant!

Construction Bookkeeping And Accounting System Diagram And Table

|

Skill Level |

Job Title |

Payroll Cost |

|

|

Level - 7 |

Business Planning |

Extremely High |

|

|

Level - 6 |

Financial Analyst |

Very High |

|

|

Level - 5 |

Systems Engineer |

Higher |

|

|

Level - 4 |

Accounting |

High |

|

|

Level - 3 |

Bookkeeping |

Medium |

|

|

Level - 2 |

Data Entry |

Low |

|

|

Level - 1 |

Paper Handling |

Lowest |

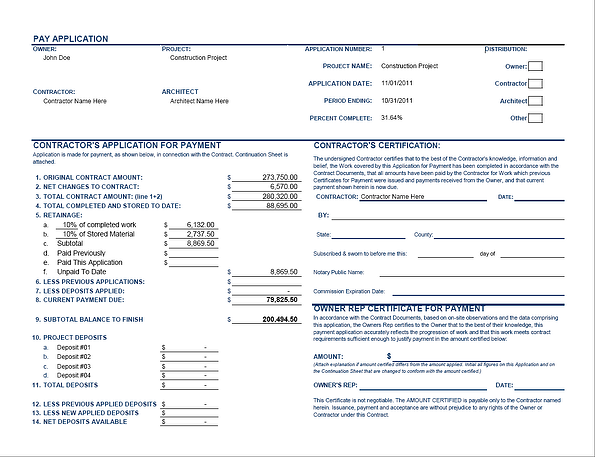

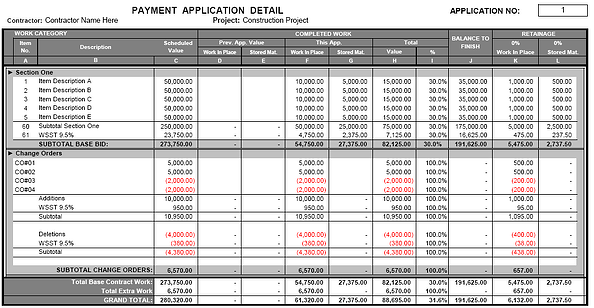

Recently A Builder Who Constructs Spec And Custom Homes as well as a few custom remodel projects contacted us because his in house bookkeeper could not provide him with Job Costing Reports or Work-In-Progress Reports that made any sense.

To Make Matters Worse she could not get Invoices and Progress Invoices to their clients on time and when they were delivered they were usually wrong and did not flow well which meant the client could not easily understand the costs that were being incurred and where the money was going. QuickBooks does not do Progress Invoicing well at all, Job Costing and Job Profitability yes, multiple invoices NO!

She is very good at providing the two most basic financial reports Profit And Loss and the Balance Sheet and yet everything else was not useful to the contractor. The Job Estimates vs. Actuals Detail Report shown below is a sample of what the QuickBooks file produced.

Notice The Dollar Amounts In The "No item" Row. That means the transactions were input just fine for generating a properly basic financial reports Profit And Loss and the Balance Sheet and when the contractor's tax accountant looked at the report he said it looked fine and in fact the entire report was not needed in order to fill out the annual tax return so he could not understand what the contractor was upset about. Tax preparers make horrible construction accountants and the other way around!

The Contractor Was Extremely Frustrated And In A Panic so he searched for someone who understood how construction accounting works so he decided to find someone local and get some answers. As it turned out there are dozens of accountants and bookkeepers who say they can do construction accounting, restaurant accounting, lemonade stand accounting, social media, consulting, coaching and whatever else you need including mowing the lawn and washing the dishes.

He Hired A Cheap Bookkeeper that turned out to be very expensive in the long run because she did not have a clue about construction accounting; however, she did have a lot of small business customers including a few handyman. She used the built in QuickBooks for Contractors template to setup his construction accounting file and that is when the trouble started.

QuickBooks Setup For Construction is the foundation of everything. Get this wrong and it is like pouring a concrete foundation for a single story house and then trying to build a skyscraper on it. It works great for a while, until it collapses because none of the reports make any sense. Unfortunately the built in construction template that comes with QuickBooks does not work well for anything beyond a Handyman and in some cases it does not work well there either.

The reason is simple QuickBooks makes money selling software and add on services not contractors bookkeeping services. For the record I love QuickBooks because it makes my life and my contractor's client lives a whole lot easier!

If you are not familiar with the differences between construction accounting and regular accounting it can be summed up like this:

Regular Accounting is done when a business is setup, customers come to it, make purchases and leave. It is roughly 80% of all accounting and that is all they teach in schools, colleges and universities and like any skilled profession it requires a minimum of 10,000 hours to fully master it. The financial reports, Profit & Loss and Balance Sheet are based on simple equations like Sales - Expenses = Profit.

Construction Accounting is done when a contractor sets up a construction company, then the contractor packs up the entire company into trucks and vans and takes it to the customer or client does the work and leaves. It is roughly 15% of all accounting and it is learned in very expensive private tutoring, seminars, and unpaid internships if you can find someone willing to accept you. Similar to the difference between a family doctor and a medical specialist becoming a qualified construction accountant requires another minimum of 10,000 hours to fully master it. The financial reports, Profit & Loss and Balance Sheet are still based on simple equations like Sales - Expenses = Profit.

The Main Difference Is Construction Reports. Job Costing, Job Profitability, Work-In-Process and many other special reports contractors need in order to know where they are making and losing money and to get those answers requires a lot more complex equations for example: Sales + (Work In Process - Earned Value) - Direct & Indirect Cost of Goods Sold - Expenses = Profit.

By the time he figured out his cheap bookkeeper had caused more harm than good by causing him to not get the financing he needed to build more homes and the extra income taxes he paid because of not having a proper Work-In-Process and Earned Value reporting system it was almost too late.

Then he searched the web and found us and when we provided a proposal he was shocked and dismayed and said "But I already spent all this money on someone else. Can't I at least get credit for that?" The answer was of course, no. In fact it cost more than it should because we had to undo most of what was done wrong in the first place.

The Chain Of Events Happened Like This:

#01 Our Tech Support People Helped him upload a copy of QuickBooks onto our server. Click here to learn more.

#02 We Helped Him Get A Scanner installed in his office and our tech support people linked it to our paperless server so he could send documents, which we entered into QuickBooks while it was being worked on.

#03 A Few Days Later we had his QuickBooks file repaired enough for him to start looking at it and generating some useful financial and construction reports.

#04 The Same Day we setup access to our online financial reporting tool which allowed him to generate reports and graphs without opening QuickBooks. The Short Video Below Tells The Whole Story

#05 We Trained His Administrative Assistant to scan documents and generate reports for the contractor and act as liaison between our two companies so the contractor could focus his attention on operating and growing his construction company.

His construction company is doing well know and growing steadily. The next project will be to integrate a Comprehensive Business Plan with an exit strategy for the day when he decides to sell his construction company and retire.

Construction companies regularly squander huge sums of time and money in situations where they could have brought in help from someone that had already learned the lessons needed. It is tempting to save money by hiring cheap labor or doing it yourself, but this approach often ends up costing more. Some common business examples I have witnessed:

-

Construction companies, adding new estimating software convince themselves that since they are contractors and have some technical skills they can figure it out for themselves and save time and money.

-

Construction companies that are adding new Business Process Management systems try to reduce the cost of outside resources, by doing large parts of it themselves.

In both cases the common result is they learned a costly lesson. There are many other examples.

Learning from experience is a key part of personal and business skill development, but it only has value if you gain from the experience. Don’t waste valuable resources on tasks that won’t pay off for you. Focus your time on those activities you have the skills, tools and passion for. Let someone else fill in the gaps. The most successful construction company owners and business leaders that I have met, all have large networks of people and organizations they can outsource too and get help from when they need it.

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

In 2004 Our Co-Founder Randal DeHart - Passed the PMP (Project Management Professional) exam after several years of construction project management experience and with an emphasis on systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve.