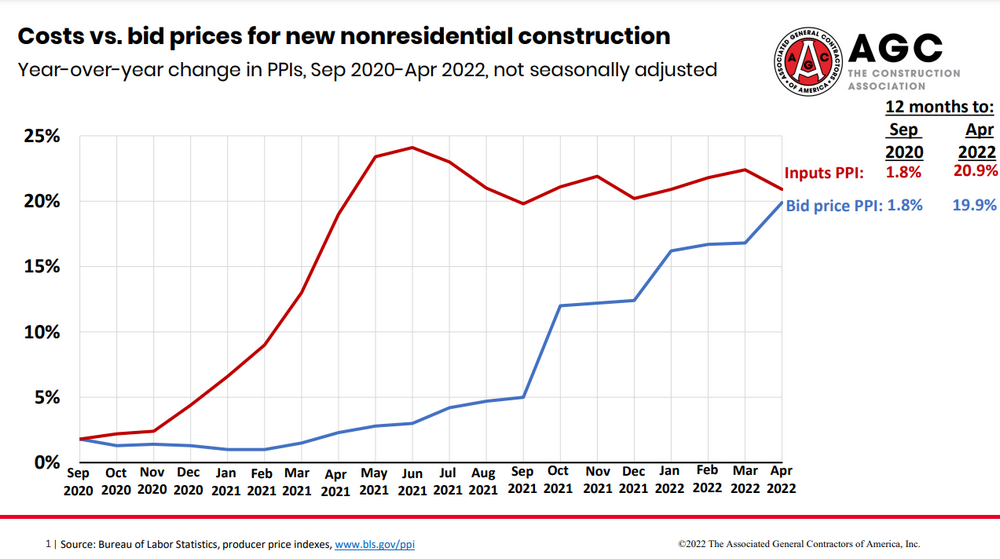

Prices of materials and services used in new nonresidential construction leaped nearly 21% in April from year-ago levels, according to an analysis by the Associated General Contractors of America of government data. The association urged the Biden administration to provide relief to hard-hit employers by ending tariffs on key construction materials and reconsidering its recently proposed buy America regulations that will make it harder for firms to find and pay for key construction materials.

“Nonresidential contractors have endured 12 months of 20% increases in the cost of items they need to build projects,” said Ken Simonson, the association’s chief economist. “While they have been able to pass some of those increased costs on to clients, most of those increases have come out of their own bottom line.”

The producer price index for inputs to new nonresidential construction — the prices charged by goods producers and service providers such as distributors and transportation firms — rose 0.8% from March to April and 20.9% over the past 12 months. An index for new nonresidential building construction — a measure of what contractors say they would charge to erect five types of nonresidential buildings — rose 4.1% for the month and 19.9% from a year earlier. April was the 19th consecutive month in which the cost index rose more than the bid-price index on a year-over-year basis, Simonson added.

A wide variety of inputs accounted for the increase in the cost index. The price index for diesel fuel jumped 86.5% over 12 months. The index for aluminum mill shapes climbed 44.8%. The index for architectural coatings such as paint soared 32.1%. There were increases of more than 20% in the indexes for plastic construction products, which rose 29.9%; truck transportation of freight, 27.4%; steel mill products, 25.1%; and roofing asphalt and tar products, 20.8%.

In addition, there were double-digit increases in several other price indexes that affect construction costs, Simonson noted. He cited as examples the index for insulation products, which rose 19.6% over 12 months; gypsum products, 17.8%; copper and brass mill shapes, 16.8%; paving mixtures and blocks, 14.4%; and concrete products, 10.9%.

Association officials said the best way to keep costs from rising even more is to allow contractors to buy materials from the widest possible range of suppliers and to eliminate measures that artificially inflate the cost of products.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.