The construction industry runs on credit. Contracts are almost never paid up front, so contractors provide labor, materials, and equipment on credit with their customers. As a result, every construction business records transactions to Accounts Receivable (A/R) until they actually receive payment. If your company uses QuickBooks – one of the most popular entry-level accounting platforms for contractors – you already have built-in tools that can help you manage, track, and report on their accounts receivable. In this article, we’ll show you how to manage A/R in QuickBooks, with screenshots to help you navigate the process.

Construction companies in particular need to pay close attention to their A/R balances and review them regularly. Slow payments are a chronic problem in the building industry, and payment delays can quickly escalate into cash flow problems. Reviewing A/R gives you insight into how long it takes your customers to pay you. QuickBooks gives you data that can help you identify chronic slow-paying customers, and decide when to take a more hard-nosed approach to collecting what you’re owed.

Learn more: The Ultimate Guide to Construction Accounting

Setting up Accounts Receivable in QB

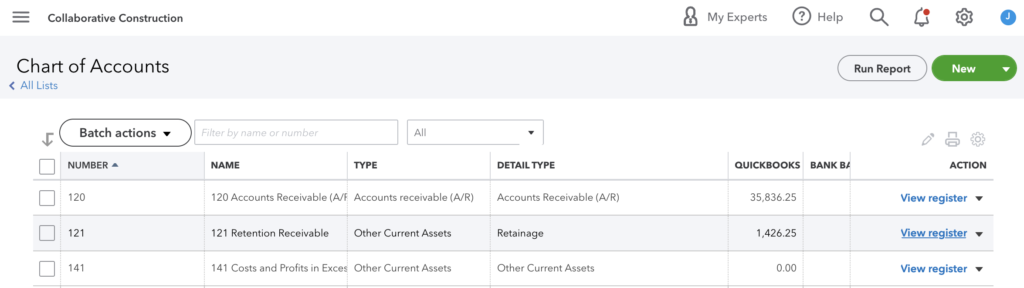

Out of the box, QuickBooks provides a standard Chart of Accounts that includes A/R. This account tracks amounts that are waiting to be collected. However, construction companies that deal with retainage will need to create an extra account to track it separately.

If you don’t have retainage withheld from your payments, you may be able to use the standard accounts that QuickBooks provides. But you’ll likely need to customize your Chart of Accounts in QB to track other construction-specific transactions, depending on your accounting method.

Contractors can track retainage in an account called Retention Receivable, Retainage Receivable, or Accounts Receivable – Retainage. You need to track retainage amounts separately from A/R because it’s not collectible yet. Your contract sets the terms and deadlines to invoice for retention. Once you submit an invoice for retainage, those amounts are then tracked in the A/R account.

Managing Accounts Receivable in QuickBooks

The great thing about using construction accounting software is that, as long as you have your Chart of Accounts set up correctly, QuickBooks manages the accounting transactions for you. When you generate an invoice, QuickBooks automatically adds it to Accounts Receivable. When you record a payment from a customer, QB automatically moves that amount from A/R to Cash.

But the real value comes in the accounting reports you can view. In QuickBooks Online, you can break out A/R reports by customer, by days overdue, and overall. Depending on what your results reveal, you may need to ramp up collection activities with some customers or revise payment terms.

The beauty of QuickBooks software is that it’s pretty simple to get a bird’s-eye view of A/R and your processes, which can be tweaked or maintained at status quo.

Related: 8 Powerful Ways Contractors Can Improve Their Accounts Receivable

Accounts Receivable Reports in QuickBooks (with screenshots)

Here is a more granular look at some of the QuickBooks AR functions and reporting capabilities. Note: The steps and screenshots below apply to QuickBooks Online. If you are using other versions of the software, the steps may vary slightly.

Navigating to your A/R Reports Menu

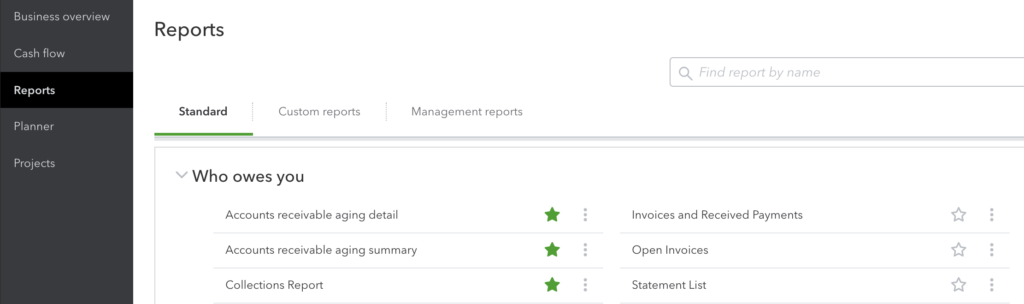

1. From the Home Screen, click on the Business Overview option in the menu.

2. Select Reports.

3. Scroll down to the section titled, “Who owes you.” You’ll see three A/R reports: Aging detail, Aging summary, and Collections report.

Accounts Receivable Aging: Detail & Summary

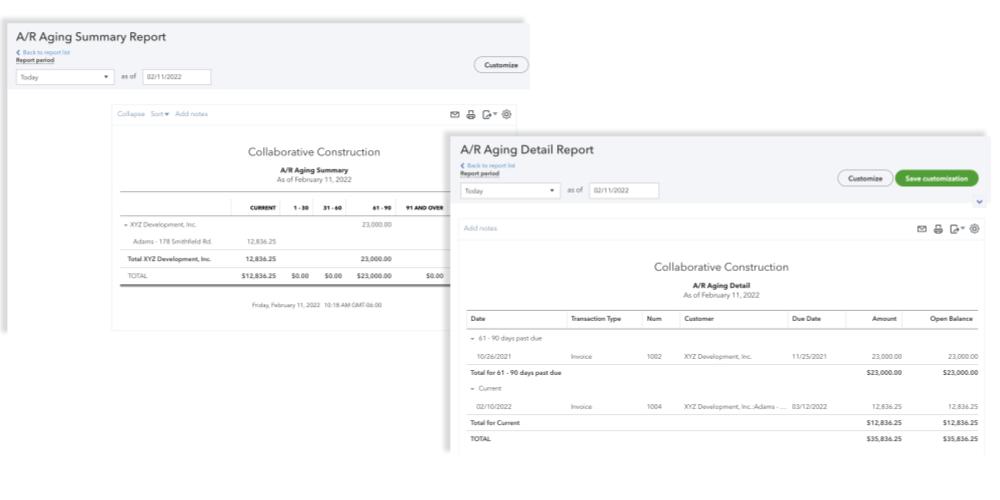

The aging detail and aging summary reports are practically identical, showing both current and overdue accounts in different views.

The A/R aging summary gives an overview of your invoices, grouped in columns by days outstanding (1-30 days, 31-60 days, 61-90 days, 91 days and over). The rows show invoices grouped by customer.

The aging summary helps you quickly identify how much each customer owes, and which customers have the highest overdue amounts.

If you have set up your QuickBooks account to do job costing correctly, the aging summary will show a breakdown of open projects under each customer.

Accounts receivable aging detail gives you more, well, detail. It groups rows by days outstanding, and you can customize the columns to view only the detail you need to track. This view is useful for focusing on groups of accounts based on their age. You can zero in on accounts that are 31-60 days old, for example, to spot trends or problem customers that need attention.

Collections report

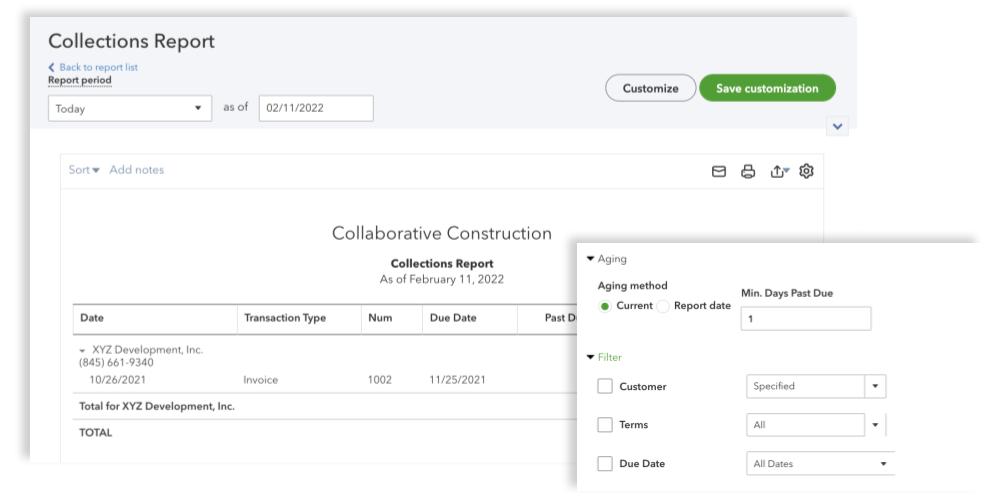

The collections report in QuickBooks shows only overdue accounts. Like the other A/R reports, you can customize the collections report to adjust time parameters or to filter by customer, invoice due date, etc.

This report can give you extra insight into your collection practices, and potential changes to your collection processes that could help you improve.

Using A/R reports to measure progress

QuickBooks A/R reports show you a snapshot in time, and can help you identify problem customers that are causing cash flow problems for your company. But contractors will get more value from these reports by tracking their progress over time.

Many construction companies like to establish Key Performance Indicators (KPI) for their businesses. QuickBooks reports can give you the data you need to calculate collection KPIs so you know whether you’re hitting your goals.

Learn how to use QB data to calculate KPIs:

Using QuickBooks to track lien rights on A/R

Aside from improving cash flow, one of the main priorities for construction companies when reviewing A/R is tracking their lien rights. A mechanics lien is the most powerful tool in a contractor’s collection toolkit, but it has an expiration date. Every state has a specific deadline by which contractors must file a lien claim, often based on the last day you provided work or materials in an invoice.

Learn more about mechanics lien rules in every state

While QuickBooks can’t help you here, Levelset software easily integrates with QuickBooks to track lien deadlines on your outstanding invoices, exchange lien waivers, and notify you when you need to take action. So you never miss a lien or notice deadline again.