Conquering the Compensation Conversation

Construction Business Owner

MAY 24, 2021

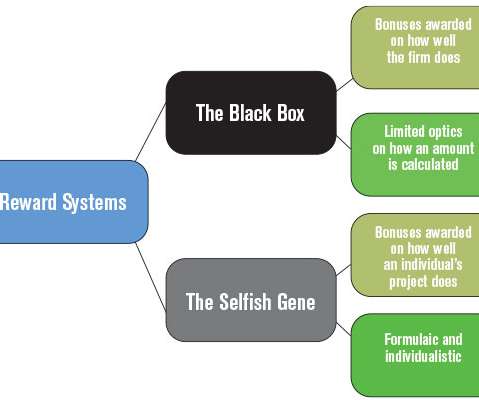

Conquering the Compensation Conversation. Compensation can be an icky subject. While “icky” might be the least technical adjective to use, many business leaders feel their skin crawl as the topics of base compensation and bonuses enter the conversation. Alex Headley. Mon, 05/24/2021 - 07:30.

Let's personalize your content