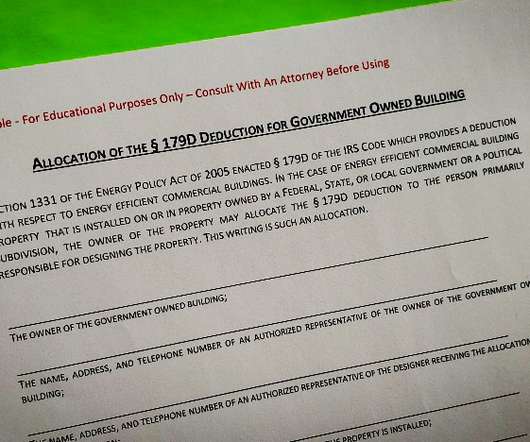

179D Tax Deduction Allocated from Government Buildings

Green Building Law Update

FEBRUARY 23, 2020

The IRS has issued guidance, that a designer is a person that creates the technical specifications for installation of energy efficient commercial building property (or partially qualifying commercial building property for which a deduction is allowed under § 179D). Selection of the ideal software for a particular building type can be key.

Let's personalize your content