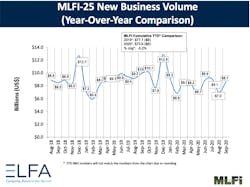

Overall new business volume in the equipment-finance sector rose 24 percent in September to $8.7 billion, compared to $7.0 billion in August. Compared to September 2019, volume was down 13 percent. Additionally, credit approvals totaled 72.9 percent, up from 71.0 percent in August.

The data comes from the Equipment Leasing and Finance Association’s Monthly Leasing and Finance Index (MLFI-25).

“Despite the drop in September year-over-year new business, a look at the data beginning with the advent of the pandemic in February shows that the industry, in general, is holding its own,” said association president/CEO Ralph Petta, in a prepared statement. “In fact, anecdotal evidence from some ELFA member companies indicates they are enjoying a very strong year. Tempering this positive data point, however, is a spike in losses—not surprising, given that the losses, in all likelihood, reflect customers in distressed industry sectors significantly impacted by the economic downturn resulting from the Covid pandemic.”

Said Anthony Sasso, Head of TD Equipment Finance, in a statement:

“The pandemic continues to have a negative impact on the overall economy, and this data demonstrates that our industry is not immune. However, the 24-percent growth in month-to-month volume in the September 2020 MLFI-25 is promising.”

The MLFI-25 reflects capex, or the volume of commercial equipment financed in the U.S.

Source: Equipment Leasing and Finance Association