The July 27th announced agreement by Democratic Senate leaders for a sweeping $369-billion clean energy and carbon reduction spending package sets the stage for a host of permit process changes that could benefit dozens of natural gas, electric transmission and other projects—including the controversial $6-billion Mountain Valley natural gas pipeline in West Virginia and Virginia.

Some broad details of the permitting reforms pushed by Sen. Joe Manchin (D-W.Va) to gain his signoff of the deal with Senate Majority Leader Charles Schumer (D-N.Y.) were revealed by Manchin's office on Aug. 1. These are to be part of a separate bill aimed for enactment by Sept. 30.

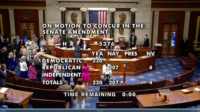

Senate Democrats could clear the proposed Manchin-Schumer bill—the Inflation Reduction Act of 2022, which also includes about $300 billion more in health care and other funding—before the August congressional recess begins on Aug. 5 by using the budget reconciliation process that requires only a simple majority to pass.

But the bill’s fate is not assured, and the path to passage is littered with potential stumbling blocks, numerous sources say.

Democrats, clean energy advocates and other supporters say it would reduce greenhouse gas emissions by 40% over the next decade. But some GOP members and trade groups, including the U.S. Chamber of Commerce and the Associated Builders and Contractors, say they oppose the bill because of the corporate tax hike and provisions that support union apprenticeship programs.

At an Aug. 2 GOP press briefing, Shelley Moore Capito (R-W.Va.), Senate Environment and Public Works ranking member, called on Manchin to release legislative text for permitting reform before any Senate vote on his funding bill, which she said "has too many questions."

Arizona Democrat Kyrsten Sinema is widely seen as the likely key obstacle to swift passage in the Senate. She has not yet voiced support for or opposition to the package, but media reports indicate she opposes the bill's tax provisions.

Also, while the reconciliation approval process requires only 51 votes, several Democrats could be unable to vote due to COVID-19 or other health reasons, potentially hampering that vote total.

Liam Donovan, a principal at Bracewell, LLP, a strategic communications and law firm, adds that the process could also be delayed by the current Senate parliamentarian, who he says has taken “longer than expected at every turn dating back to last fall.” However, he says, “If and when the bill passes the Senate, it will achieve escape velocity, and the House is almost certain to follow."

Permit Reform Detailed

Although exact wording of the permit reform legislation has yet to be determined, Manchin’s office released a document summarizing “energy permitting provisions” that will likely form the basis of the measure. It is set to be incorporated into the federal government’s fiscal 2023 funding bill, which would require a 60-vote majority and Republican support to pass.

The provisions include placing a two-year limit on federal environmental reviews of currently undefined “major” energy projects, and one year for smaller projects, according to the Manchin document. A designated lead agency would coordinate concurrent environmental review processes for inclusion in a single document.

In addition, a yet-to-be-determined “statute of limitations” would be placed on court challenges to energy infrastructure projects. Federal agencies would have a maximum of 180 days to respond to any federal court action remanding or vacating a permit.

Ross Pilotte, senior vice president of the non-profit Permitting Institute, which advocates for infrastructure permit improvements, calls the proposal “a good starting point for the reformation of the permitting process in this country,” one that represents “a significant set of stepping stones that will allow us to get to a place where we will start seeing project permitting times decrease.”

Pilotte formerly served as a senior advisor on the Federal Permitting Improvement Steering Council during the Trump administration.

The legislative agreement would also require the President to designate at least 25 “high-priority energy infrastructure projects that would reflect a balance” of those related to critical minerals, nuclear, hydrogen, fossil fuels, electric transmission, renewables and carbon capture, sequestration, storage and removal.

Criteria for the list would include projects that reduce consumer energy costs, improve energy reliability, hold decarbonization potential and promote energy trade with U.S. allies.

Other changes would incorporate Trump-era revisions to the Clean Water Act, including curbing states’ ability to use section 401 permits to block natural gas pipelines and other infrastructure; clarify Federal Energy Regulatory Commission oversight of interstate hydrogen pipeline, storage, import and export facilities; and enable the agency to issue construction permits for electrical transmission projects deemed in the national interest by the U.S. Secretary of Energy.

The Mountain Valley pipeline is the sole specified project in the agreement and a longtime priority for Manchin, who recently asserted that the nearly completed project should be “at the top of the heap” of U.S. energy infrastructure. Since receiving FERC approval in 2017, it has been repeatedly sued by environmental and conservation groups claiming that its threats to waterways along a 303-mile route have not been fully addressed.

Citing the pending legal and permit actions, lead project developer Equitrans Midstream asked FERC in June to extend the pipeline’s completion target to 2026.

Manchin’s list of provisions calls for relevant agencies “to take all necessary actions to permit the construction and operation” of Mountain Valley. Further litigation would be transferred to the U.S. Court of Appeals in Washington, D.C., from the federal appellate court in Richmond, Va. Equitrans Midstream has complained in the past of unfavorable rulings by the same three-judge panel on the latter court who have heard many of the project lawsuits.

Environmental groups have expressed concern that the agreement would minimize hurdles to advancing fossil fuel-related projects, while experts questioned whether lawmakers could legally influence court actions this way, according to BloombergLaw.

But Pilotte says renewable energy initiatives stand to benefit as well. “Projects like Coastal Virginia Offshore Wind, Empire Wind, Line 5 Replacement in Michigan and the Port of Corpus Christi Deepening Project can all benefit from reform at this level,” he says.

Reform of the Section 401 wetlands permit process under the Clean Water Act is another potential selling point of the agreement, Pilotte says, as it would eliminate state-level differences. “Spelling out the requirements for issuing a 401 Water Quality Certificate is absolutely essential for predicting not only efficient permitting timetables but realistic ones,” he says.

Carbon Reduction Gains

Several green building groups have also noted provisions that would ultimately reduce greenhouse gas emissions from buildings and building materials.

The bill would provide $250 million to develop and standardize environmental product declarations, which identify carbon impacts, and $100 million for low-embodied carbon labeling for construction materials and products for use in federally funded transportation and building projects.

The bill also would provide $2.5 billion to expand the U.S. General Services Administration's standard for low-carbon material procurement for ports to federal buildings.

John Milko, a consultant for the climate and energy program at Third Way, says that the incentives for low-carbon material procurement, coupled with tax credits for solar, wind, carbon capture and utilization, and other projects geared toward decarbonization on the energy supply side, would work synergistically.

The Manchin-Schumer bill would “make vital investments to enhance embodied carbon transparency and create a more robust market for low-carbon materials, while at the same time bolstering the competitiveness of U.S. manufacturers by providing them the tools they need to decarbonize,” he says.

Sasha Stashwick, Natural Resources Defense Council director of industry policy, climate and clean energy, concurs.

“As the federal government is one of the largest purchasers of cement, steel and other common industrial building materials used in public works projects, federal procurement of low-carbon industrial materials can be a critical accelerator of U.S. industrial transformation, signaling a robust market for early adopters of incentives and decarbonization technologies,” she says.

Post a comment to this article

Report Abusive Comment