Procore Technologies, and Dodge Data & Analytics recently released the results of the 2022 Top Business Issues for Specialty Contractors Report. The Dodge report highlights issues impacting specialty contractors, including workforce management and the construction supply chain.

Five types of specialty contractors: mechanical, electrical, plumbing, steel and concrete were represented in the survey by Dodge. 537 specialty trade contractors in the US, Canada, UK and Australia/New Zealand responded and company sizes ranged from $2 million to over $2 billion in annual revenue.

Labor Shortage and Supply Chain Will Continue to Afflict the Industry

90% of specialty contractors reported their projects have been negatively affected by a shortage of skilled labor. Industry economists and insurers expect the current shortage to worsen: on average, 33% of the current workforce is planning to retire in the next five years.

The labor shortage, alongside supply chain disruptions, is having a significant impact on specialty contractors. About one third of specialty contractors (31% cannot pass material cost increases on to owners on half or more of their projects. This is highest among steel contractors (43%), who face a very volatile cost market. Specialty contractors identify poor resource management (ie: labor, materials, equipment) and poor client communication as top drivers of rework.

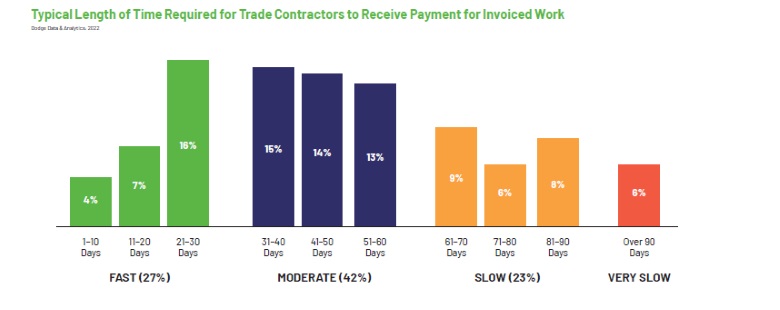

One other factor that jumps out from the data is that more than two-thirds of payments made to subcontractors are received more than 30 days after invoicing. This varies somewhat by trade, with about one-third of electrical (34%), concrete (33%) and mechanical (32%) contractors receiving payment within 30 days, but just 16% of steel contractors.

"When you're just one of these companies, you don't understand that this is an endemic issues," says Steve Jones, senior director Industry Insights Research at Dodge Data and Analytics who oversaw the survey. "This is kind of a theme that showed the extent of the problem and then we looked at what people either are doing or think they are going to plan to do in order to deal with this problem."

Many specialty contractors cited construction technology investments as a way to improve productivity.

Rework is Significantly Impacting Profit Margins

Improper resource management is driving unplanned rework for many respondents, which is a key drain on productivity, schedule management and cost control. In addition to that, unbillable change orders represents lost revenue, especially for larger companies. On average, 32% of project revenue is lost because of unbilled and unpaid change orders, according to survey respondents.

Leveraging Construction Technology Can Help Alleviate Some of the Industry’s Most Pressing Challenges

On average, specialty contractors report that 20% of workers’ time is currently spent on low-productivity tasks, such as tracking down information or documenting information on paper. According to the report, 39% of respondents state they still use whiteboards and spreadsheets.

“The challenges specialty contractors are faced with today highlight the need for a connected platform built to address their needs,” said Will Lehrmann, head of product, specialty contractors, at Procore. “Several key takeaways show that the power of technology can help improve productivity and efficiency—as well as combat the workforce and skill shortages—that many specialty contractors are still facing.”

The report cities best practices for technology evaluation and implementation that include:

- Identifying needs before evaluating options

- A phased roll-out plan

- A structured process for engaging key stakeholders

- Metrics to determine success

Post a comment to this article

Report Abusive Comment