As the country continues to deal with the economic and health crises caused by the COVID-19 pandemic, forecasters are cautiously optimistic for the future but warn that meaningful growth is still several months away.

Following an initial rebound, “the economy has noticeably slowed in the past couple of months,” says Richard Branch, chief economist for Dodge Data & Analytics. “We see that slow growth continuing into the fourth quarter and quite frankly into the first three months of 2021.” He expects the economy to ramp up in the second half of 2021, but adds that an additional stimulus package, as well as a vaccine that is widely available by mid-2021—two factors still not set in stone—are built into the Dodge forecast.

“This will not be a copy/paste recovery compared to the aftermath of the Great Recession,” says Branch. “The pandemic and economic fallout means that opportunities for growth in the construction sector are going to be harder to find.”

Dodge reports a 14% decline in the dollar value of construction starts in 2020, with an expected rebound of 4% in 2021. The drop in 2020 will bring starts to $738 billion, growing to nearly $771 billion in 2021.

Julian Anderson, president of financial consultant Rider Levett Bucknall, agrees that the economy is unlikely to accelerate in the first half of the coming year.

“My forecast for the first few months of 2021 is gloomy,” he says. “The U.S. faces some big challenges.”

In addition to the current surge in COVID-19 cases, Anderson counts the “looming, chaotic expiration” of additional Coronavirus Aid, Relief, and Economic Security (CARES) Act unemployment assistance and the end of the moratorium on student loan repayments and evictions among the obstacles the country will face come January.

These factors, along with others, “combine to depress confidence in the economy,” he says , and will result in a “crippled federal bureaucracy and strained state and municipal budgets.”

|

Related Link |

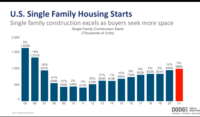

Single-Family Starts Rising

Dodge estimates that total residential starts are expected to rise 5% in 2021, following a 2% drop in 2020. Single-family housing starts will rise 7% in 2021, to $254 billion, the highest since 2007. Branch notes that single-family housing is one of the few markets tracked by Dodge to see an increase in 2020, at a rate of 4%.

“This will not be a copy/ paste recovery compared to the aftermath of the Great Recession.”

– Richard Branch, Chief Economist, Dodge Data & Analytics

“Lower mortgage rates are clearly overpowering any labor market or economic concerns that exist,” says Branch. He also points to workers moving away from cities—due in part to widespread remote work amidst the pandemic—as a reason for higher demand in the single-family market. “The pandemic is clearly opening up a whole new opportunity of living arrangements for those folks who have that flexibility to work from home.”

Robert Dietz, senior vice president at the National Association of Home Builders, agrees. “Overall, home builder confidence is at a data series high, as sales have outpaced construction,” he says. “Housing demand is being driven by historically low interest rates, demographic tailwinds and a desire for more space, which in turn is leading to construction gains in lower density markets.”

NAHB estimates a 6% increase in single-family housing in 2020, followed by a nearly 3% jump in 2021 and a 2% uptick in 2022. Growth in this sector will continue, says Dietz, due to the fact that “we are still below production levels needed” to meet the demand for housing.

Conversely, the multifamily market is on the decline. “The strength in single family directly translates into weakness on the multifamily side as we see that demand shift away,” says Branch. Dodge estimates a 14% decline, to $86.4 billion, in the dollar value of multifamily housing starts in 2020, with an additional 1% drop, to $85.5 billion, in 2021.

Hotel, Retail Starts Plunge

In the commercial sector, overall starts are estimated to have dropped 23% in 2020, Dodge reports, to $107.4 billion. A small 5% increase, to $113 billion, is expected in 2021. “It is going to be a long slow road back for the commercial sector,” says Branch.

The dollar value of hotel construction starts fell 46% in 2020, to $9.7 billion. “Hotels were already on a downward track,” Branch notes, and has been “dramatically” affected by the pandemic. In 2021, Dodge forecasts an additional 7% decline, to $9 billion.

“We expect ongoing gains for single-family construction through 2022.”

– Robert Dietz, Senior Vice President & Chief Economist, National Association of Home Builders

Retail construction, another sector already in decline, was hit particularly hard by the pandemic. Branch expects the sector to “continue to suffer,” with several companies filing for bankruptcy in recent months. With a new wave of the virus currently on the rise across the U.S., foot traffic will continue to decline, causing further economic hardship for retail, says Branch.

Dodge predicts a 25% decline in the dollar value of retail starts in 2020, to $12.5 billion, but does see a 7% rebound in 2021, largely based on the influx of new homeowners in suburban areas. “Growth in those areas will pull some retail activity with it,” says Branch, but, at $13.3 billion, “that’s barely where the market was way back in 2009.”

Retail’s loss is warehousing’s gain, as warehouse starts were the one growing sector in the commercial market in 2020, Dodge reports. Warehouse starts grew 2% this year, to $30.7% billion, with another 8% increase expected in 2021.

“What’s been very bad for retail has of course been exceptional for warehousing as this sector continues to benefit from the growth in e-commerce,” says Branch.

Long Road Ahead

Despite some growth in the last quarter, “the economy is not healthy. Nowhere near healthy,” says Ed Sullivan, chief economist at the Portland Cement Association. PCA forecasts total construction put-in-place will fall 1.5% by the end of 2020 to $985.4 billion, then rebound slightly—by 0.6%—in 2021.

The consumer, says Sullivan, will play a key role in the nation’s recovery. “Irrespective of whether the states act, consumers will vote with their feet. If they’re concerned [about COVID-19], they’ll stay home,” he says.

Sullivan also stressed the importance of additional federal stimulus in repairing the economy. Insufficient government aid, he says, would “hinder this recovery.”

An FMI Corp. market forecast estimates that total construction put-in-place will reach $1.36 trillion by the end of 2020, a 0.2% drop from 2019’s total. In 2021, FMI projects a 8.7% decline.

“There is a good chance that the second half [of 2021] will see a return to more normal times.”

– Julian Anderson, President, Rider Levett Bucknall

Total residential work is expected to increase 2.6% by the end of this year, but decline 11.1% in 2021, FMI forecasts. Non-residential put-in-place is projected to decline 4% in 2020, and a 9.3% decrease is in store for next year.

Jay Bowman, principal at FMI, says that while the economy will strengthen in 2021, construction spending tends to lag by one-and-a-half to two years. “Most of the spending in 2020 represents existing backlog or ongoing projects,” he says, estimating that as much as two-thirds of construction spending each year represents projects awarded the prior year or even earlier. “The full effects probably won’t be felt until 2022.”

As we move past the “gut punch” from earlier this year, Bowman sees a number of differences in the current recovery from the one following the Great Recession. In particular, geography will be a “defining characteristic of the post-pandemic recovery,” he says. “Although this always has influence on how recessions and expansions are experienced, it will be much more pronounced [this time].”

Bowman points to the difference in measures adopted across state and local levels to curb COVID-19 infections, as well as industry exposure, as key indicators going forward. “Those markets with greater dependency on social interaction, such as business travel and tourism, are likely to struggle more than those with a broader industrial base,” he says.

Anderson agrees, calling the recovery “K-shaped,” reflecting diverging markets. Sectors such as data centers, logistics and water treatment bounced back after the initial shutdown, while hospitality and related sectors “continued to suffer.”

Longer term, however, Anderson is hopeful for the future. “I am optimistic that the incoming Biden/Harris administration will get on top of the chaos caused by the end of the moratoriums and deferrals [and] Congress will come together to provide additional support to the economy and fund a sizeable infrastructure package,” he says.

“There is a good chance that the second half [of 2021] will see a return to more normal times, perhaps even busy for designers and contractors,” Anderson adds.

Post a comment to this article

Report Abusive Comment