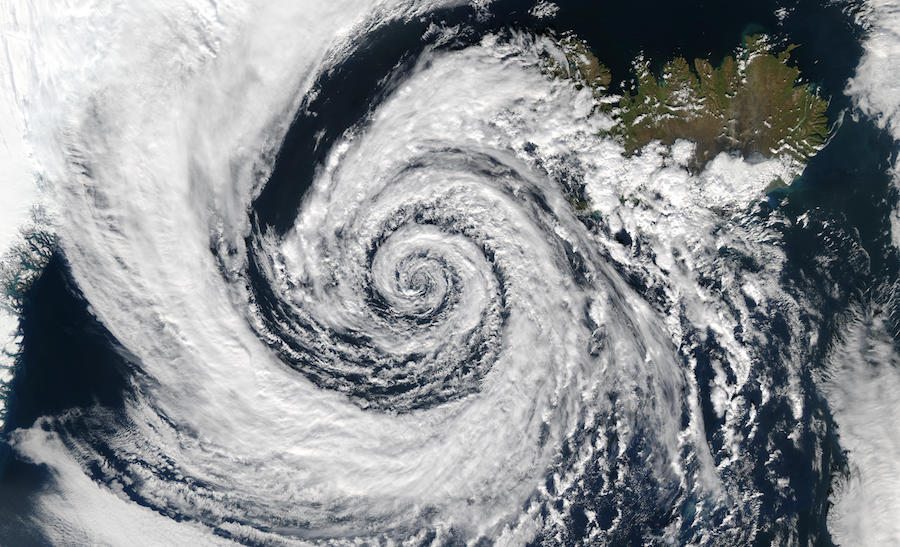

There is a downside to the great market we are enjoying. Some construction enterprises will grow too fast and I’ve learned that too high of a growth rate can be lethal. Most construction enterprises were involuntarily downsized when the current market recovery began. As a result, many were already struggling financially and suffering from very limited cash reserves. Eagerness to return to the pre-recession size can drive a firm’s rate of growth beyond safe limits. Combine this with the acute and worsening labor shortage and, because growth eats cash, that many companies are exposed to a “perfect storm” of risk.

Symptoms of financial stress have already begun to surface: Unexplained tight cash flow, disproportionate increases in overhead, higher staff turnover, more disputes inside the company, slipping work quality and late accounting information and accounting staff heading for the door.

Just about every construction enterprise participating in this excellent market is enjoying faster rates of growth. Yet symptoms of financial stress have already begun to surface: Unexplained tight cash flow, disproportionate increases in overhead, higher staff turnover, more disputes inside the company, slipping work quality, late accounting information and accounting staff heading for the door. One of the last signs of distress: excuses for all of the above.

This unique category of “growth risk” is difficult to recognize or anticipate because it is the result of insufficient cash flow, not profit. When more work is put in place each month and each quarter, accounts receivables flourish but cash diminishes. Slow pay intensifies the problem and tends to get worse during rapid growth because the more a company owes, the longer it often takes to pay.

Rapid growth usually requires increases in overhead expenses and, when resources are stretched thin, estimated production costs may be missed. And because of the growth, all this is occurring at a time when a trusted staff is being diluted by new, untested people who may not perform as anticipated.

Companies with limited cash reserves can, of course, borrow against accounts receivable, but there are limits. When reached, the limits dry up cash flow quickly and can lead to problems paying bills. Suddenly subcontractors are walking off jobs, vendors are demanding COD and, in the worst case, payroll is missed. These will lead to work slowdown or stoppage, which can progress to the loss of bank and/or bond credit. If this is not the end of the road, it is very close to it.

When things like that happen, I always hear, “If only someone would have warned me.” Growth eats cash and rapid growth gorges on cash. Fortunately, there are thresholds that will assist in understanding the impact of different rates of growth on your business. An annual growth rate under 15% has minimal risk. Growth rates in excess of 15% involve risk that expands as the rate increases up to 25% which is reasonable risk. Growing at a rate of 25% to 50% involves moderate risk and over 50% is serious risk. The intention to undertake a growth rate over 25% demands detailed planning about how the work will be accomplished and funded. What will the costs of expansion be? How will these costs be paid?

Responsibility of Management

Managers are responsible for recognizing and measuring the exposure and determining how these risks will be managed and mitigated. Managers have to determine in advance how far financial and business resources can be stretched before approaching the critical stage. Managers have to must ascertain beforehand if cash flow will be threatened and identify what the first sign of financial distress will be. Successful contractors operating in years to come will know how to predict the impact of different growth rates. And they will know when to walk away from excessive expansion risk and will do so without regret.

An outdated belief suggests, “If the work is there, go after it. We’ll figure out how to do it later.” This is the same as saying, “If the risk is there, embrace it.” Many companies are probably already feeling some stress. It may not be financial distress yet, but if staff turnover is running high and and overhead is climbing during excessive growth, trouble may be approaching. Developing the capacity for growth requires an investment and takes time. If history repeats, contractors trying to make up for lost ground too quickly will load up on work increasing their risk. In some cases they won’t even know it. We cannot control the market, but we can control our response to it

Post a comment to this article

Report Abusive Comment