As we close out 2023, most of the major economic indicators look positive, with some surprisingly good. One key leading indicator, architectural billings, predicts a solid 2024 for the construction market, with a slower rate of growth than 2023. According to the American Institute of Architects, overall gains in spending are projected at just under 6%, with almost 3% for the commercial sector, 15% for industrial facilities, and 4% for institutional buildings.

Yet volatility in the labor market—particularly the skilled labor market—remains a problem. While many of the supply chain problems that plagued the pandemic years have been worked through, volatility in construction input prices, especially energy prices, remains a problem as well.

Meanwhile the housing market, which has been in recession for much of 2023, looks poised to make a comeback. On the commercial side, billions in infrastructure investment from the Inflation Reduction Act and the CHIPS and Science Act are still working their way into the economy.

It looks like 2024—for good and for bad—might have some surprises in store.

How We Got Here

Early in the year many forecasters were predicting a recession, brought on by rising interest rates. That recession never happened. Real gross domestic product (GDP) increased at an annual rate of 4.9% in the third quarter of 2023.

The key federal funds rate—the rate that banks pay to borrow money—now stands at 5.25%-5.5%. That’s the highest since early 2001. At the time of this writing, the US average for a 30-year fixed mortgage stands just a little above 6.5%. Meanwhile, the annual inflation rate for the United States was 3.1% for the 12 months ending in November (according to Labor Department data published Dec. 12, 2023). While not yet at the Fed’s target rate of 2%, it represents a steep decline from the peak of 9.1% in June of 2022.

But perhaps more important than that 2% target is how wages are keeping pace with inflation. According to the Federal Reserve Bank of Atlanta’s Wage Growth Tracker, the 12-month average of median wage growth stands at 5.6%—making inflation-fighting less crucial to policymakers.

Labor in the Driver’s Seat

The main reason for that growth in wages is the tight labor market, with companies in competition to hire and retain talent. November 2023 data from the Bureau of Labor Statistics has overall US unemployment at 3.7%, and the country has been at or near that number for most of the year.

The construction industry unemployment rate rose to 4.8% in November. On a year-over-year basis, construction industry employment has increased by 200,000 jobs, an increase of 2.6%, but that increase was not even across all segments of the industry. Heavy and civil engineering added 3,300 positions (some of which reflects investment in large infrastructure projects), while nonresidential building and nonresidential specialty trade lost 1,100 and 800 jobs, respectively.

Yet even as the labor market cools, high-demand jobs saw explosive wage growth in 2023, this according to an end-of-year report from compensation analysis company Payscale (www.payscale.com). Wages for the top 10 in-demand jobs for the year experienced growth between 18% and 24%. Number 3 on that list of jobs was, in fact, Master Plumber, with a 21% wage growth ($82,700 median annual pay).

The State of Construction

While final numbers for the year are not yet in, total construction spending in 2023 is forecast at $1,960 billion, an increase of 6.0% over 2022—with nonresidential spending leading that growth. With nine months in the year-to-date for 2023, total all-construction spending is up 4.6%. Nonresidential buildings spending is up 22% year-to-date compared to Jan.-Sep. of 2022.

As of the third quarter of 2023, nominal construction spending maintained its steady upward path. It is important to note, however, that much of the topline growth is likely being driven by price inflation versus volume.

Associated Builders and Contractors’ Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Despite the monthly increase, backlog is currently 0.8 months lower than at July’s cyclical peak. The sharpest declines over that span occurred among contractors with more than $100 million in annual revenues, who collectively reported fewer than 10 months of backlog in November for the first time since the second quarter of 2018.

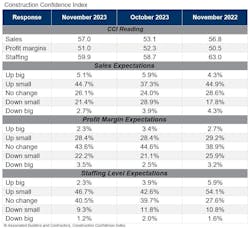

ABC’s Construction Confidence Index readings for sales and staffing levels increased in November, while the reading for profit margins fell. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

The Bill Comes Due

As we move into 2024 the key watchword is debt, both public and private.

The end of the pandemic saw an explosion of spending. People who had been forced to stay at home found themselves with unexpected savings and were eager to purchase goods and services. It was expected that as these reserves dried up, spending would as well.

Instead, the American consumer went right on spending. According to the Trading Economics website (tradingeconomics.com), consumer spending in the United States increased to $1,5461.38 billion in the third quarter of 2023 from $1,5343.55 billion in the second quarter of 2023—all in the face of inflation.

And much of that spending was made possible through debt. According to data from the Federal Reserve Bank of New York, total household debt rose by 1.3% to reach $17.29 trillion in the third quarter of 2023. Mortgage balances increased to $12.14 trillion, credit card balances to $1.08 trillion, and student loan balances to $1.6 trillion.

Meanwhile, the national debt—the total amount of outstanding borrowing by the US Federal Government accumulated over the nation's history—is now approaching $34 trillion. Interest payments to cover the debt soared to $659 billion in fiscal year 2023 (which ended September 30) according to the Treasury Department.

Perhaps a better number to look at is the country’s debt-to-GDP ratio. Right now, that stands at 129%, significantly better than some countries with serious economic or demographic problems (Japan right now leads the world with a ratio of 262%) but nearly double the global average of 66.1%.

What Comes Next

The US economy is powered by spending and at some point, both the US consumer and the US government will be forced to cut spending—but will that be this year?

For the US government, the two obvious solutions to tackling the debt are cutting spending and raising taxes, both of which are politically unpopular (and 2024 is a presidential election year). The hope among the political class is to avoid those hard choices by growing the economy to the point where tax revenues are sufficient to chip away at the debt.

Another option would be to “inflate away” the debt. High rates of inflation reduce the real value of debt, allowing governments to, in effect, pay off debts using money that is worth less than when they originally borrowed it. This flies in the face of stated policy goals. The option of last resort, default on the debt, would spark a global economic crisis. It looks like the status quo for the coming year, with (hopefully) some policies that will improve the situation down the road.

For the consumer, it looks like the rate of spending is already coming down: economists expect spending this quarter to slow to around a 2% pace.

In fact, the economy shows signs of cooling almost everywhere you turn: less spending, falling inflation, a loosening labor market. This all aligns with slower global economic growth. According to projections from the International Monetary Fund, world economic growth will slow from 3% in 2023 year to 2.9% in 2024.

If that wasn’t enough, the Fed has recently signaled it is done with its current program of raising interest rates.

Add all that up and the most likely scenario for the US economy in 2024 is a year of moderate growth, although probably at a slower rate than in 2023. The same goes for the construction industry, with most of the real growth weighted on the nonresidential side as the steady drip of Federal infrastructure money wends its way to the people doing the work.

But…

However, there are a few key factors to keep in mind.

The Fed now stands poised to start cutting interest rates. As soon as those cuts begin to lower mortgage rates a lot of people who have been holding off on purchasing a home will get back into the market. At the same time, a lot of people who have held off on selling their home—why walk away from that 3% APR you locked in back in 2019?—will feel more comfortable putting their homes up for sale. Lower rates and an increase in stock for 2024 could mean a flurry of activity on the residential side.

Also, the markets saw an end-of-year rally. The Dow Jones industrial average in December hit its first record high close since January 2022, while the S&P 500 is within striking distance of its all-time closing finish. The S&P 500 rose 24.2% for the year.

There is a class of homeowning, stock-owning consumers who, more likely than not, got a significant raise or bonus at the end of 2023. Even in the face of rising debt, all those combined may have them feeling wealthy enough to keep spending right on through 2024.

Next, there will always be X-factors in the economy beyond anyone’s ability to predict. Pandemics, natural disasters, geopolitical uncertainty, terrorist attacks and more could all factor into the coming year.

And last, although the US economy avoided a recession in 2023, recession and expansion are natural parts of the economic cycle. There may or may not be a recession in the next 12 months, but there will be a recession at some point, and it never hurts to be prepared both financially and mentally.