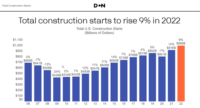

While GDP growth will plummet in the second quarter, the recession will be short lived, according to Dodge Data & Analytics most recent forecast, "The Potential Impact of Coronavirus (COVID-19) on Construction Starts", released April 9. Dodge expects a 2.5% decrease in the first quarter, followed by a much sharper of 18.3% in the second quarter of the year.

Still, “under the assumption that infections peak in May, begin to slow down and abate by July, and that the economy starts very slowly to return to normal, we get a boost in the second half” of the year, says Richard Branch, chief economist at Dodge Data & Analytics.

At a seasonally adjusted rate, 6.6 million people filed for unemployment last week, according to the Department of Labor. This follows two weeks of equally devastating numbers, 6.9 million in week of March 28 and 3.3 million in the week preceding. As people return to work, Dodge predicts an 11% increase in quarter three, which will level off to a more modest 2.4% boost in quarter four. For 2020 overall, Dodge predicts a 2.2% decrease in GDP, with a rebound of 2.7% in 2021.

[For ENR’s latest coverage of the impacts of the COVID-19 pandemic, click here]

Contractors also expect the second quarter to be the toughest, according to a survey conducted by Dodge. While 39% of those surveyed expects COVID-19 to have a strong current impact on their businesses, that number jumps to 47% in three months before falling to 29% in six months’ time. “Second quarter projects starts will be down, in some categories rather sharply,” says Branch. But as we enter the third and fourth quarters, activity will normalize, he adds.

On the residential side, the Dodge forecast predicts a 13% drop in all housing in 2020, with a 3% increase in 2021. Single-family housing, already expected to experience a downturn due to the lack of affordability and entry level homes, will see a 10% drop. The current crisis “will absolutely eat away at the single family market,” says Branch, adding that second quarter home sales could decline by 50% from the first quarter of the year. By 2021, Branch expects the single-family market to begin to recover, at a rate of 5%.

In non-residential work, commercial starts are slated to fall 16% this year, with retail and hotel work taking the largest hit, at 33% and 31%, respectively. Warehouses, buoyed by the increasing demand for online shopping, are expected to drop only 1%. “What’s been bad for retail has been great for warehousing,” says Branch. Manufacturing is expected to drop 22%, while institutional buildings will see a smaller decline, at 7%. Non-building starts will drop 16%, but rally in 2021 with a 13% increase.

Post a comment to this article

Report Abusive Comment