NEW YORK, N.Y. — At a seasonally adjusted annual rate of $563.3 billion, new construction starts in November fell 5 percent from the previous month, according to Dodge Data & Analytics. The decline represented a partial pullback after the 13 percent increase reported for total construction in October, as nonresidential building lost some momentum following its improved October pace. Decreased activity was also reported for housing in November, while the nonbuilding construction sector (public works and electric utilities/gas plants) held steady. During the first eleven months of 2015, total construction starts on an unadjusted basis were $597.9 billion, up 8 percent from the same period a year ago.

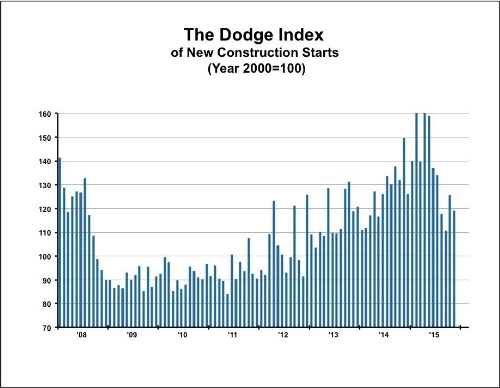

The November statistics lowered the Dodge Index to 119 (2000=100), compared to 125 in October. November was still above the lackluster activity reported for August and September, when the Dodge Index averaged 114.

Nonresidential building in November dropped 13 percent to $175.4 billion (annual rate), following its 33 percent rebound in October. The commercial building categories as a group have been the cause of much of the volatility over the past two months, sliding 29 percent in November after soaring 53 percent in October. Office construction plunged 43 percent in November after being lifted in October by the start of two very large data centers, valued at $570 million and $300 million respectively, and several large office buildings. The major office projects that were reported as November starts were generally smaller in scale than what took place in October, and included such projects as a $155-million insurance claims service center in Plano, Texas and a $70-million corporate headquarters in Rapid City, South Dakota.

The garage and service station category in November decreased 39 percent after soaring 119 percent in October with the start of two large consolidated rental car facilities at Chicago’s O’Hare International Airport and the San Antonio, Texas International Airport. Store construction in November fell 30 percent, although it did include groundbreaking for a $100-million outlet mall in Daytona Beach, Florida, and warehouse construction retreated 13 percent. Hotel construction in November stayed even with its October pace, helped by the start of the $193-million hotel portion of the $400-million Eighth and Howell convention center hotel complex in Seattle, Washington. The manufacturing plant category in November was able to show improvement following its depressed October activity, rising 38 percent with the upward push coming from two automotive-related projects — a $307-million expansion to a General Motors plant in Arlington, Texas and a $250-million expansion to a Mercedes-Benz plant in Vance, Alabama.

The institutional building group in November receded a slight 1 percent after registering 23 percent growth in October. Weaker activity was reported for amusement-related work, down 12 percent, although some support was provided by the $181-million convention center portion of the Eighth and Howell convention center hotel complex in Seattle, Washington. November declines were also reported for transportation terminals, down 19 percent; and religious buildings, down 4 percent. The educational building category in November rose 3 percent, showing further growth on top of the 21 percent increase reported in October. Large educational facility projects that reached groundbreaking in November included the $288-million health education campus at the Cleveland Clinic in Cleveland, Ohio, a $206-million public health laboratory at the Aberdeen Proving Grounds in Maryland and a $79-million elementary school modernization in Washington, D.C. Healthcare facilities in November edged up 1 percent, aided by the start of a $109-million hospital in the Orlando, Florida area. The public buildings category improved 42 percent in November, with the lift coming from a $45-million facility maintenance and repair project at McConnell Air Force Base in Kansas and a $43-million police headquarters in Orlando, Florida.

Through the first eleven months of 2015, nonresidential building was down 8 percent relative to the same period a year ago. Manufacturing plant construction fell 39 percent year-to-date, as petrochemical plant construction has retreated sharply this year following its exceptionally high amount in 2014. The commercial building group was flat year-to-date, with gains registered by hotels, up 14 percent and stores, up 1 percent; while modest declines were reported for office buildings, down 4 percent; garages/service stations, down 4 percent and warehouses, down 5 percent. The institutional building group slipped 4 percent year-to-date, with decreased activity reported for public buildings, down 1 percent; transportation terminals, down 10 percent; healthcare facilities, down 11 percent and amusement-related work, down 12 percent. The educational building category, which is the largest nonresidential building structure type by dollar volume, advanced 2 percent in the first eleven months of 2015, while the small religious building category managed a 6 percent increase relative to a depressed 2014.

Residential building in November decreased 2 percent to $257.4 billion (annual rate). Nonbuilding construction in November was reported at $130.5 billion (annual rate), essentially unchanged from its October amount.

The 8 percent increase for total construction starts at the national level during the first eleven months of 2015 was supported by gains from all five major regions, to varying degrees — the South Central, up 18 percent; the Northeast, up 17 percent; the South Atlantic, up 3 percent; the West, up 2 percent and the Midwest, up 1 percent.

Photo courtesy of PRNewsFoto/Dodge Data & Analytics.

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn!

Join our thriving community of 70,000+ superintendents and trade professionals on LinkedIn! Search our job board for your next opportunity, or post an opening within your company.

Search our job board for your next opportunity, or post an opening within your company. Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.

Subscribe to our monthly

Construction Superintendent eNewsletter and stay current.