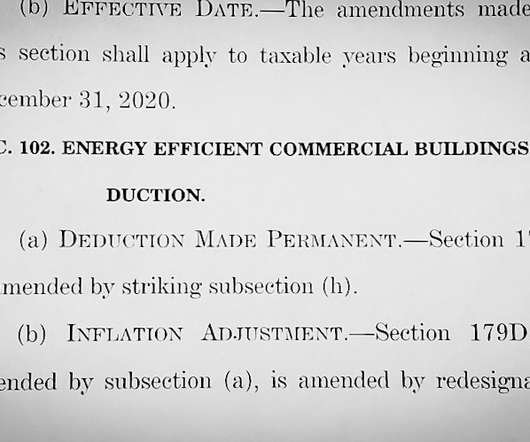

179D Tax Deduction Made Permanent by Covid Relief Bill

Green Building Law Update

JANUARY 3, 2021

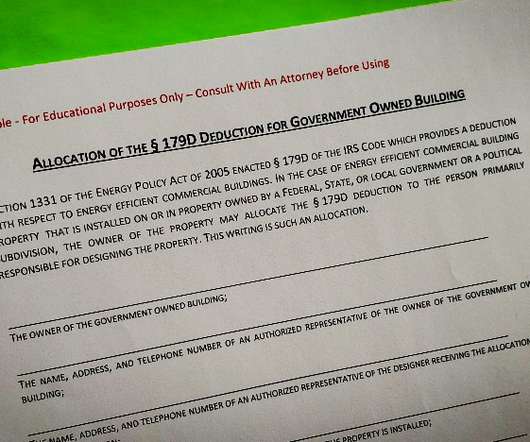

The 179D commercial buildings energy efficiency tax deduction has since 2006 enabled building owners to claim a $1.80 Simply put the 179D tax deduction reduces the green premium. With more than 24,000 green building incentives across the country, most for above code building, the 179D tax deduction has been among the most valuable.

Let's personalize your content