JOC Coefficients Less than 1.0

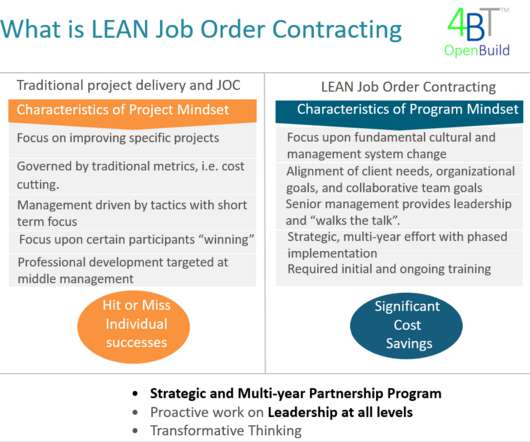

Job Order Contracting

APRIL 4, 2024

It should be used to account for contractor overhead and profit. It should NOT BE USED to account for fluctuations in material costs, labor rates, and other factors that can change during the contract term. ( should simply include contractor overhead and profit. This practice is NOT RECOMMENDED.

Let's personalize your content