Supreme Court Permits State Law Claims Against Superfund Property

Green Building Law Update

APRIL 26, 2020

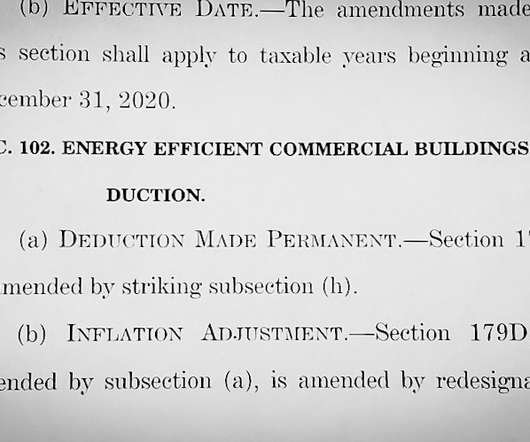

That is, the Small Business Liability Relief and Brownfields Revitalization Act of 2001, amended CERCLA, restricting liability under federal law for the cleanup and redevelopment of a Brownfields property by a person complying with a state voluntary cleanup program. You can read the Supreme Court decision at Atlantic Richfield Co.

Let's personalize your content