A Force Majeure Decision during the COVID-19 Pandemic

Green Building Law Update

JULY 5, 2020

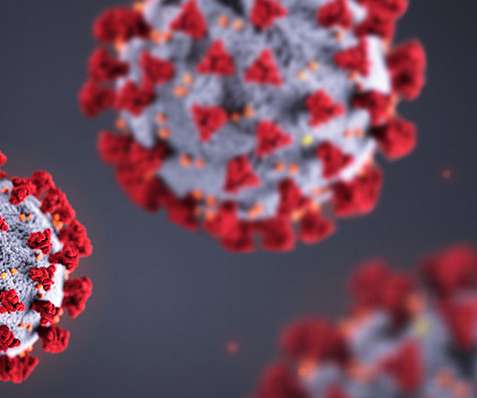

There has been much speculation and supposition about the interplay of force majeure provisions in leases and other contracts in response to government orders closing businesses during the coronavirus disease 2019 (COVID-19) pandemic, but now there is an authoritative court decision that may provide persuasive authority.

Let's personalize your content