How Excessive Design Standards Hurt Home Affordability

Pro Builder

OCTOBER 1, 2020

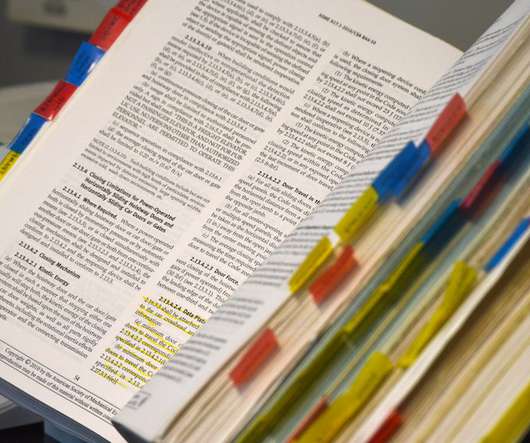

Design regulations are supposed to ensure the health, safety and welfare of residents, but superficial and excessive rules that price lower- and moderate-income families out of the market should not be prioritized over the need to address the housing affordability problem. NAHB Housing Policy Briefing. For more, visit nahb.org. .

Let's personalize your content