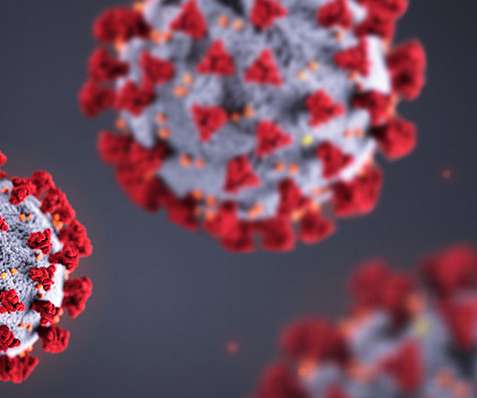

A Force Majeure Decision during the COVID-19 Pandemic

Green Building Law Update

JULY 5, 2020

In a motion in a Bankruptcy case the landlord demanded payment of post petition rent from the Hitz Restaurant Group or that the Chicago restaurant vacate the premises immediately. The restaurant argues that this clause was triggered on March 16, 2020, the effective date of an Executive Order issued by Illinois Governor J.

Let's personalize your content