5 Current Construction Industry Challenges and How Technology Can Help

Fieldwire

MAY 16, 2022

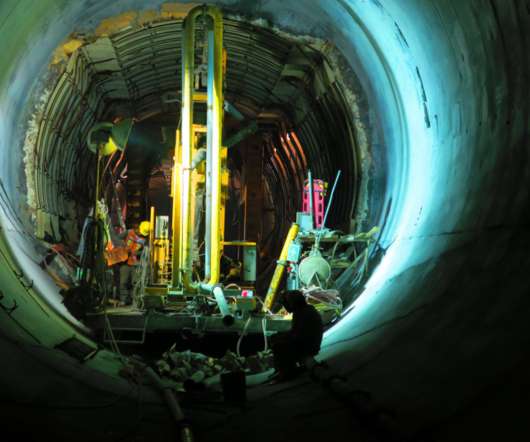

From safety training and accident prevention to AR building assistance, technology does indeed belong on the drafting table and the construction site alike. With the current supply shortage driving up the costs of construction material, waste is not only inefficient but can also dissolve the profit of a job quickly.

Let's personalize your content