Some of the Oldest Buildings in the U.S.

Natural Building

APRIL 28, 2022

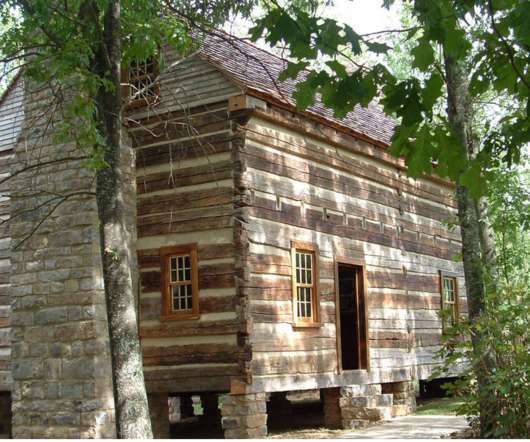

Originally constructed in Ardmore, Alabama in 1808 before being restored at to the Burritt on the Mountain museum in 2007, the Joel Eddins House is listed on the National Register of Historic Places. The 1½-story home is a unique hall-and-parlor style structure that’s not typically found in Alabama.

Let's personalize your content