20+ Fresh Releases for Autodesk Construction Cloud

Autodesk Construction Cloud

JANUARY 24, 2023

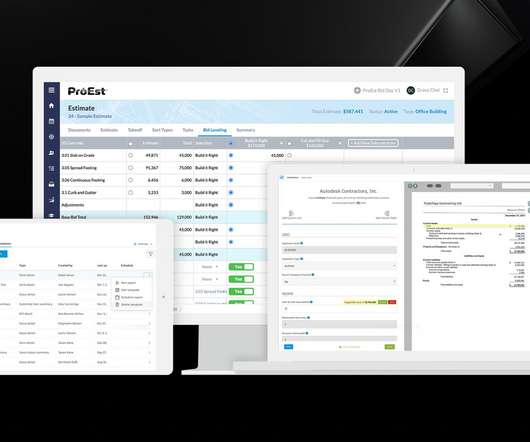

BuildingConnected BuildingConnected Pro and Bid Board Pro Visual Enhancements There are visual enhancements, mainly color changes, to both BuildingConnected Pro and Bid Board Pro. ProEst Bid Day Enhancements Incoming proposals from subcontractors can be inputted for easier side-by-side comparison, including alternates and inclusions.

Let's personalize your content