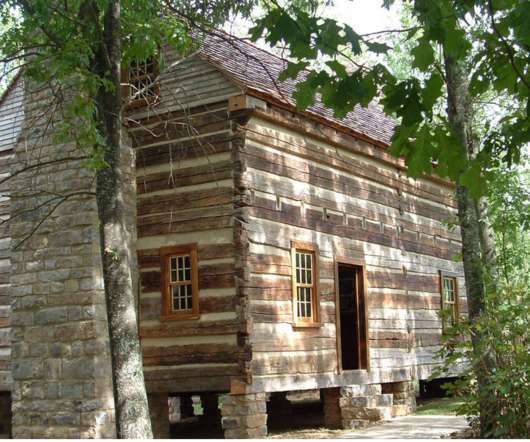

Some of the Oldest Buildings in the U.S.

Natural Building

APRIL 28, 2022

A defensive fort that can be traced to 1672, Castillo De San Marcos was built under the direction of Florida’s Spanish governor to protect the city of St. His home, which features an 18th century garden, is now a museum, owned and operated by the Missouri Society of the Colonial Dames of America.

Let's personalize your content