179D Tax Deduction Allocated from Government Buildings

Green Building Law Update

FEBRUARY 23, 2020

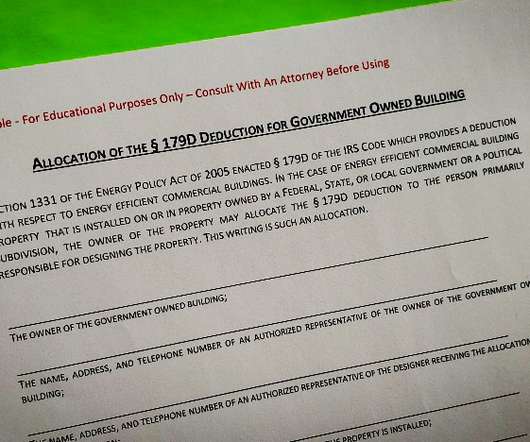

On December 20, 2019, the President signed legislation reviving the Section 179D energy efficient commercial building tax deduction and while much has been written about the much needed boost to green building, little has been said about the enormous benefits available from government owned buildings. IN GENERAL.

Let's personalize your content