How to Get Your Supers to Actually Fill Out Daily Reports

ProcurementExpress.com

AUGUST 12, 2019

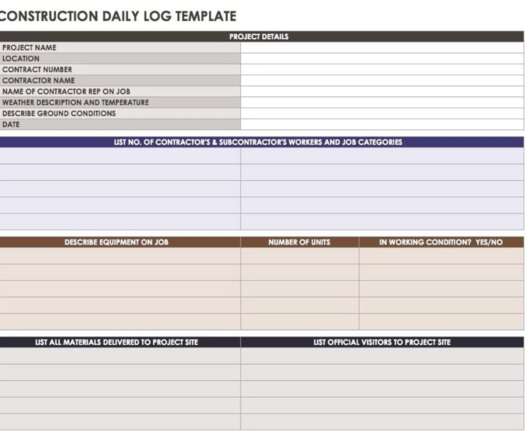

These documents contain a wealth of information, providing insights that can inform future contracts, estimates, and inventory management. This will highlight any potential safety risks. You may also want to record any information related to inventory management. The benefits of daily reports are undeniable. Materials Received.

Let's personalize your content