Fed Economist Forecasts Uptick in Single-Family Construction

Pro Builder

OCTOBER 6, 2022

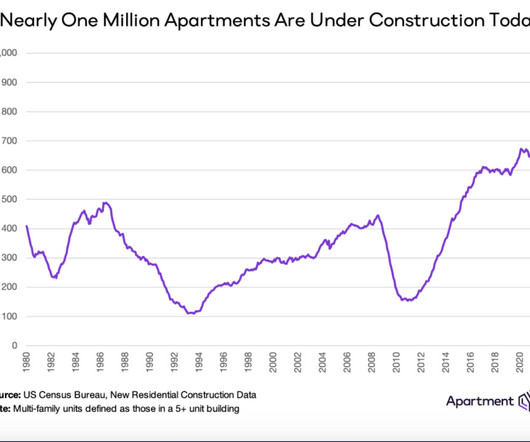

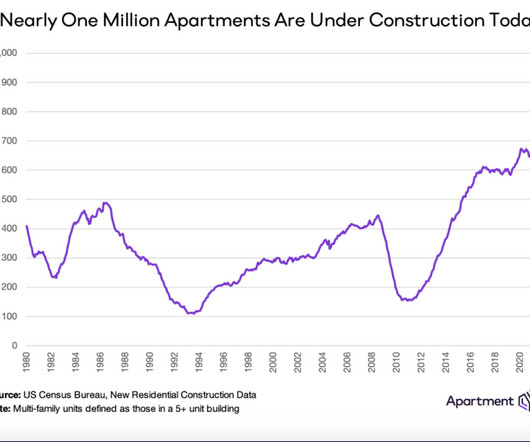

After decades of underbuilding and a recent shift to remote work, Rappaport predicts that national single-family permits could eventually rise to a long-term annual rate of 1.4 million, but a number of challenges remain for regional builders across the U.S., NAHB reports.

Let's personalize your content