2020 Guide to Construction Cost Estimating

Job Order Contracting

JULY 19, 2020

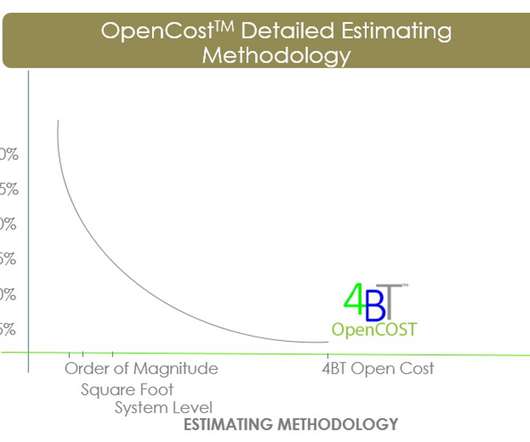

2020 Guide to Construction Cost Estimating provides a road map for applying best management practices necessary to drive financial visibility and transparency. liability insurance and allowance for small tools and consumables. Liability insurance based upon local contractor rates is also added as a percentage. Introduction.

Let's personalize your content