How Excessive Design Standards Hurt Home Affordability

Pro Builder

OCTOBER 1, 2020

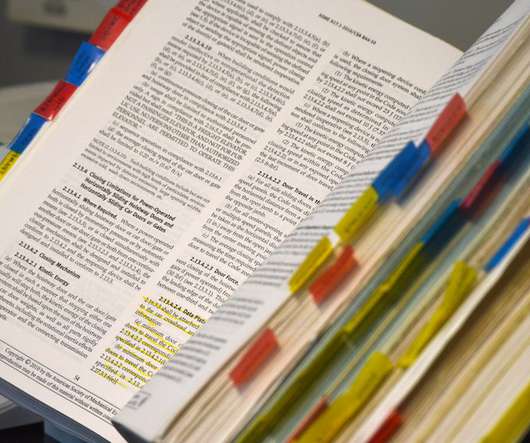

Stringent residential design standards imposed by local governments are affecting housing costs; the impact of new residential construction on the broader economy (chart). NAHB Housing Policy Briefing. Solving the Housing Affordability Crisis Requires Reshaping Public Policy. . billion in building products in 2019.

Let's personalize your content