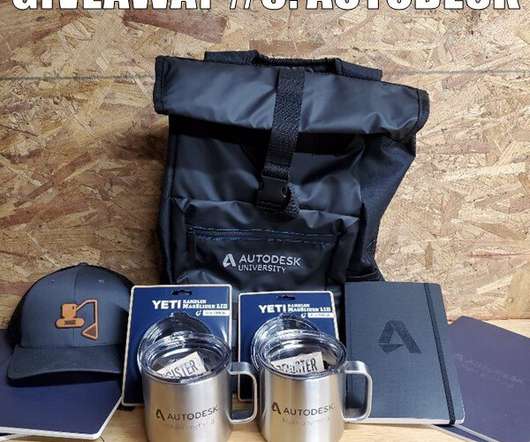

GIVEAWAY #5: AUTODESK SWAG PACK

Construction Junkie

APRIL 30, 2020

No transfer, substitution or cash alternative permitted, except by Construction Junkie, LLC in its sole discretion. Warranty, insurance, registration, and any fees or costs associated with the prizes are the sole responsibility of the Winner. Any Prize Winner shall sometimes be referred to hereinafter as the “Winner.”

Let's personalize your content