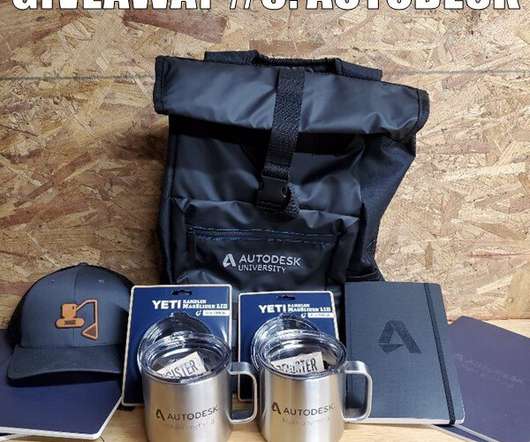

GIVEAWAY #5: AUTODESK SWAG PACK

Construction Junkie

APRIL 30, 2020

No transfer, substitution or cash alternative permitted, except by Construction Junkie, LLC in its sole discretion. All federal, state or other tax liabilities (including income tax) arising from this Contest will be the sole responsibility of each prize Winner. Limit: One Prize per person/family/household.

Let's personalize your content