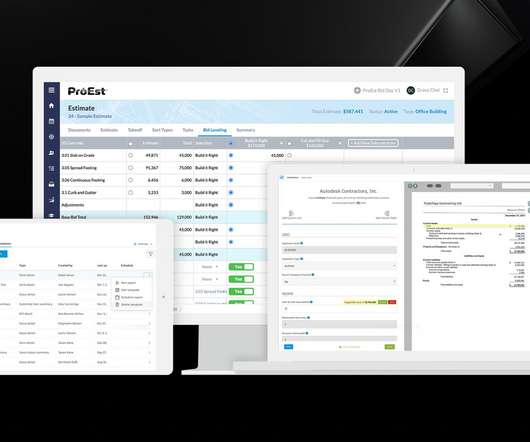

20+ Fresh Releases for Autodesk Construction Cloud

Autodesk Construction Cloud

JANUARY 24, 2023

Autodesk Build *=features in both Autodesk Build & BIM 360 Assets | Progress Tracking + Assets The new progress tracking features within the Assets tool in Autodesk Build deliver a simple intuitive way to visually markup and track asset progress on 2D sheets. The product functionality remains the same.

Let's personalize your content