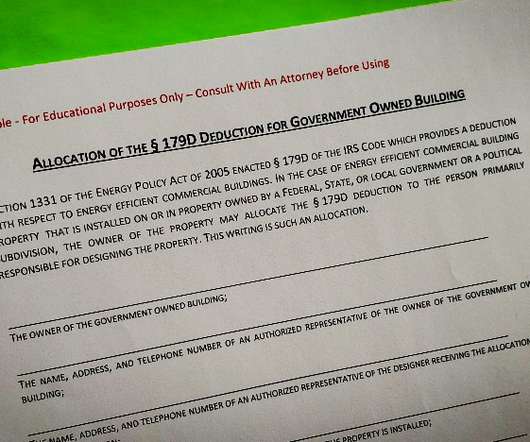

179D Tax Deduction Allocated from Government Buildings

Green Building Law Update

FEBRUARY 23, 2020

Of course, the government does not pay federal income tax such that it cannot utilize a tax deduction , so that tax deduction may be allocated to a taxpayer. Selection of the ideal software for a particular building type can be key. A partial deduction may be allocated. 2007 building. And LEED as well as 4.0 Deductions of $0.60

Let's personalize your content