2020 Guide to Construction Cost Estimating

Job Order Contracting

JULY 19, 2020

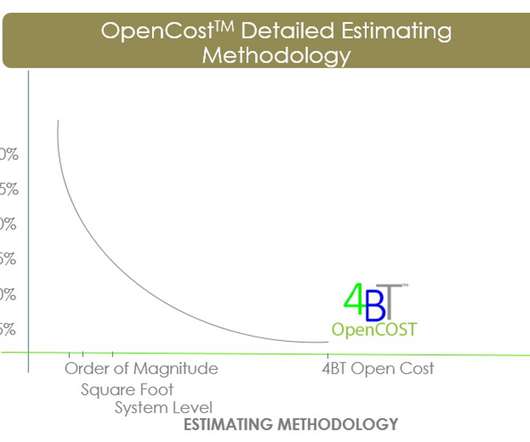

2020 Guide to Construction Cost Estimating provides a road map for applying best management practices necessary to drive financial visibility and transparency. The base rate does not include overhead and profit, however, can be added if needed. General overhead and profit can be added by percentage if desired.

Let's personalize your content