Commercial Construction Trends: Why More Clients Are Choosing the Design-Assist Model

HardHatChat

SEPTEMBER 29, 2016

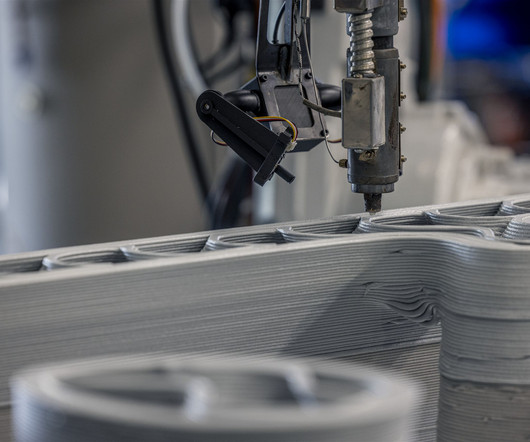

Working with a client on a design-assist or design-build basis, as Englewood Construction is with the reimagining of Stratford Square Mall, allows the commercial contractor to provide valuable input during the initial planning stages. Design-assist is a bit of a hybrid of the design-build process.

Let's personalize your content