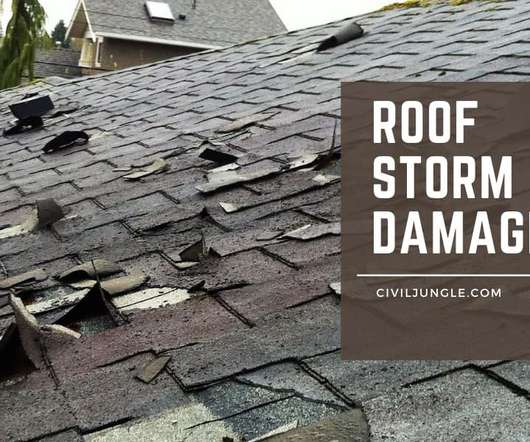

Rising Construction Costs Lead to Higher Risks

Construction Business Owner

NOVEMBER 7, 2023

These cost escalations can directly correlate to higher insurance premiums, reduced risk appetite from insurance carriers, and a lack of policy extensions for project policies. However, in the face of rising costs and shifting risk landscapes, these insurance options are becoming increasingly complex to navigate.

Let's personalize your content