Homebuyers in the Worst Position Since 2007, Experts Say

Pro Builder

APRIL 11, 2022

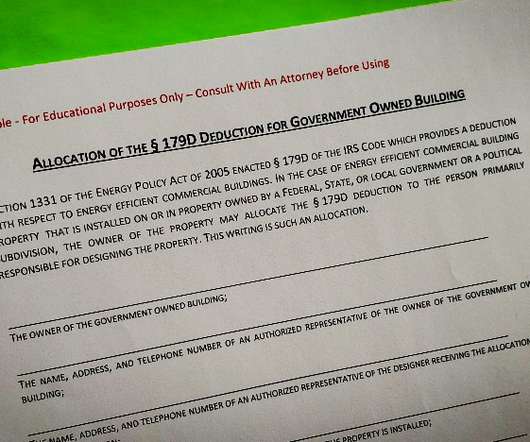

Homebuyers in the Worst Position Since 2007, Experts Say. household would have to allocate 29% of their monthly income to afford a mortgage payment on an average priced home, Fortune reports. . This swift jump in mortgage rates puts homebuyers in the worst position since 2007. Mon, 04/11/2022 - 10:09. Market Data + Trends.

Let's personalize your content